14 February 2025 • 4 minute read

President Trump announces plan for reciprocal tariffs

On February 13, 2025, President Donald Trump issued a Presidential Memorandum directing a rapid review process to determine country-specific “reciprocal tariffs” for all US trading partners based on each partner’s perceived unfair trade and economic practices.

The memorandum states that the “lack of reciprocity is one source of our country's large and persistent annual trade deficit in goods – closed markets abroad reduce United States exports and open markets at home result in significant imports.”

In signing the memorandum, President Trump said: "On trade, I have decided for purposes of fairness, that I will charge a reciprocal tariff – meaning whatever countries charge the United States of America, we will charge them no more, no less. In other words, they charge us a tax or tariff, and we charge them the exact same tax or tariff.”

President Trump directed the Secretary of Commerce and the US Trade Representative (USTR) to work with the Department of Treasury and the Department of Homeland Security Secretaries to provide assessments, for each trading partner (“both friend and foe”), of:

- Tariffs on US exports

- Unfair taxes imposed on US companies

- Other policies that impose costs on US businesses and consumers

- Exchange rate policies, and

- Any other unfair practices.

The assessments may also focus on countries that have a significant trade imbalance with the US.

This directive places a sweeping range of policies under potential scrutiny, including digital services taxes (DSTs), value-added taxes (VATs), carbon border adjustment mechanisms (CBAMs), subsidies, technical barriers to trade and discriminatory regulation, and monetary interventions, to name a few. The inclusion of trade barriers beyond tariffs indicates that the administration will likely take an expansive view of “what countries charge the United States of America” for purposes of determining reciprocal measures. See the fact sheet here.

In many ways, the breadth of this memorandum doubles down on the broad scope of the America First Trade Policy memorandum issued at the outset of President Trump’s presidency. That order set a deadline of April 1, 2025 for federal agencies to prepare and deliver reports to the President, which could, in turn, provide the legal basis for new tariffs.

The February 13 memorandum sets forth two additional steps under Section 3, which is called “Taking Action.” First, it requires that, after submission of those reports in early April, the Secretary of Commerce and USTR “shall initiate, pursuant to their respective legal authorities, all necessary actions to investigate the harm to the United States from any non-reciprocal trade arrangements adopted by any trading partners.” Presumably, the “necessary actions” mentioned could include new Section 301 or Section 232 investigations, or the use of other legal authorities or mechanisms. Second, the memorandum also directs the Secretary of Commerce and USTR, upon completion of such “necessary actions,” to submit to the President a report detailing proposed remedies. These remedies could be proposed tariffs or other trade measures.

Additionally, within 180 days of the February 13 memorandum, the US Office of Management and Budget shall assess “all fiscal impacts” of the proposed actions and submit a report to the President.

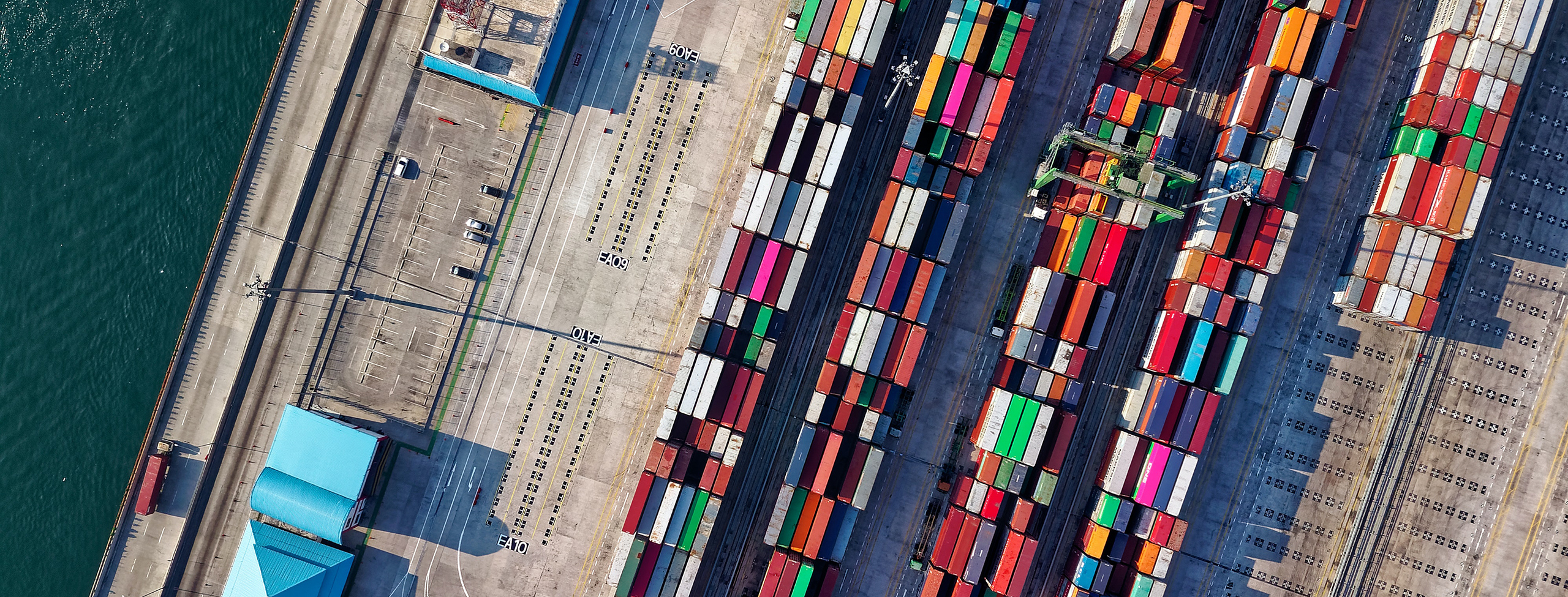

The prospect of country-specific tariffs creates significant logistical and supply chain issues for US importers that source from around the globe. Moreover, the imposition of new tariffs is likely to prompt varying retaliatory measures from trading partners. This would create an intricate web of border measures that both complicate the cross-border shipment of goods, and would carry significant and varied cost implications for global supply chains.

The White House has indicated that countries will be given a chance to negotiate agreements with the US, which raises the possibility of dozens of separate negotiations between the US and its trading partners as they seek to reduce or eliminate any new tariffs.

Please contact the authors or your DLA Piper relationship partner with any questions.