26 September 2023 • 5 minute read

Latest developments regarding the Reemtsma claim

In its ruling of 7 September 2023 (C-453/22 ), the Court of Justice of the European Union (CJEU) has now commented for the first time on the prerequisites of the so-called Reemtsma claim in cases in which the supplier was not insolvent, addressing the questions referred by the Münster Fiscal Court. In principle, the recipient of a service who has paid too much VAT due to an incorrect invoice pursuant to Section 14c German VAT Act must take civil action against the supplier.

An exception is the Reemtsma claim. Since a ruling by the CJEU in 2007 (C-35/04), such a claim is understood to be the right of a recipient of services to demand, under certain conditions, direct reimbursement of the overpaid VAT from the tax authorities instead of payment from the supplier. This is possible in cases in which the service recipient does not receive a refund of the overpaid VAT from the supplier or if this refund is excessively difficult. The exact details of when this claim can be asserted, in particular when an undue hardship exists, are disputed. In Germany, the tax authorities take a restrictive view (German Federal Ministry of Finance, Letter of 12 April 2022, III C 2 - S 7358/20/10001 :004).

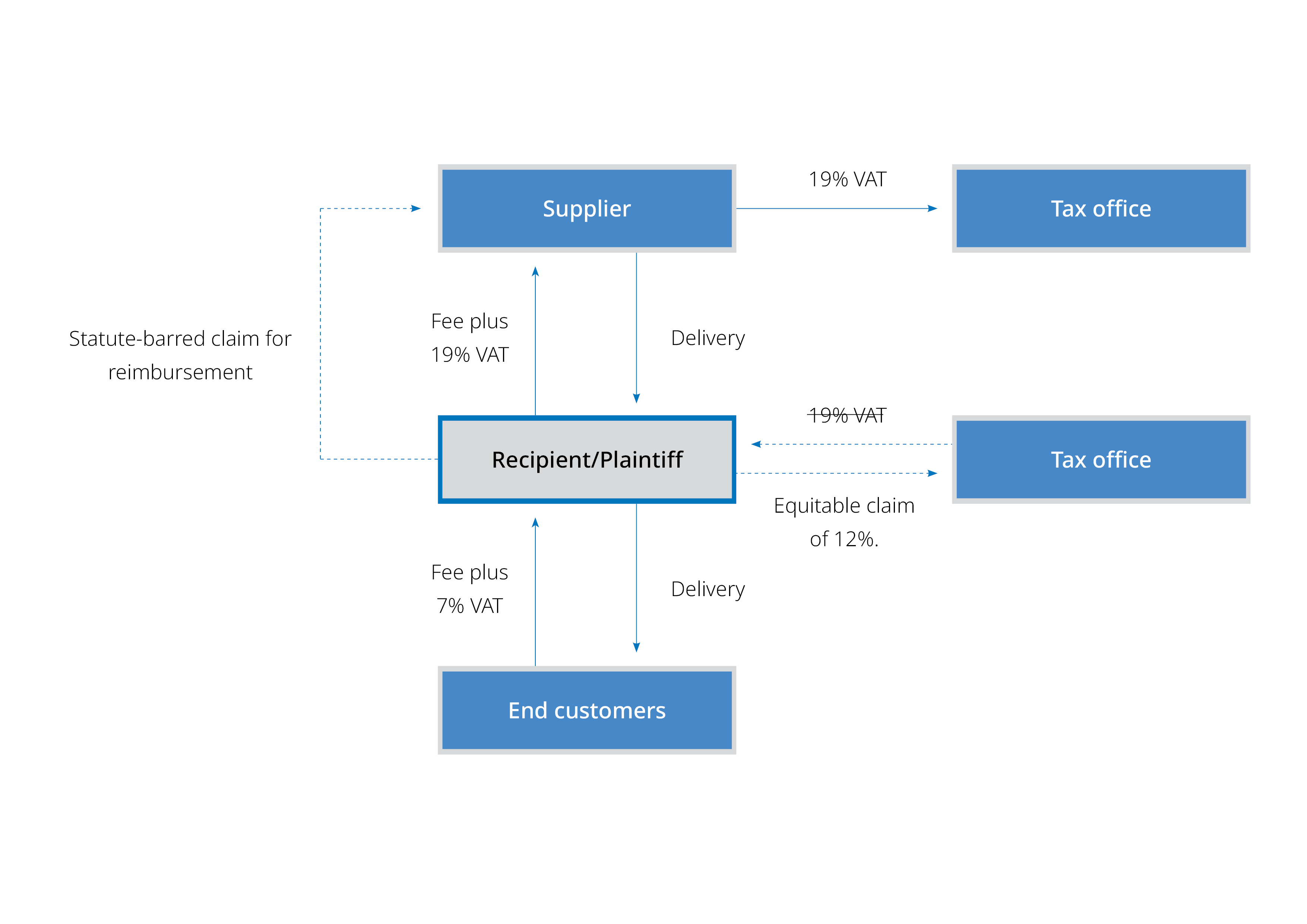

In 2011-2013, the plaintiff, a farmer and forester, purchased wood and received invoices for it with 19% VAT. The plaintiff then resold this wood as firewood. In doing so, he only reported the reduced VAT rate of 7%. The tax liability resulting from the sales made with 7% VAT (VAT to be paid) and the purchases made with 19% VAT (input tax claim) was paid by the plaintiff.

After several audits by the tax authorities, it was found that the supplies to the plaintiff were also only taxable at 7%. Accordingly, the plaintiff's input tax deduction was reduced. The plaintiff then turned to his suppliers to have them correct their invoices and pay the difference. However, the suppliers invoked the civil law defence of limitation.

Subsequently, the plaintiff filed an application for equity with the tax office for reimbursement of the amount including interest according to the Reemtsma principle. The tax office refused, so that the case was brought before the Münster Fiscal Court.

The Münster Fiscal Court referred the following questions to the CJEU:

1. Can the recipient of the service assert a Reemtsma claim against the tax office even though the supplier could still correct the invoice?

According to the CJEU, the Reemtsma claim can be asserted even if the invoice can theoretically still be corrected by the supplier. So far, the German tax authorities have rejected Reemtsma claims in such cases. This was justified with the danger of a double claim by the tax authorities. The Münster Tax Court also sees this danger, since a correction of the VAT is possible for the supplier for an unlimited period of time. Thus, the supplier could make a correction even though the recipient of the service had already been granted a Reemtsma claim. However, these considerations were not recognised by the CJEU. In the CJEU's view, the supplier is abusing his rights if he invokes the limitation period under civil law against the recipient of the service, but at the same time requests a tax refund due to a correction of the invoice. In this case, the tax office can refuse payment, so that there is no danger of a double claim.

2. How does the civil law limitation of the claim against the supplier affect the Reemtsma claim?

According to previous CJEU case law, the recipient's claim for reimbursement against the supplier must be impossible or excessively difficult in order to be able to enforce a Reemtsma claim. Until now, this usually concerned cases of insolvency of the supplier. Now the CJEU clarified that the Reemtsma claim also exists after the civil law limitation of the claim against the supplier. Such a limitation period even leads precisely to the enforcement of the claim being excessively difficult.

3. Does the Reemtsma claim also include interest?

The CJEU clarifies that the Reemtsma claim of the recipient of supplies of goods is subject to interest. The recipients of supplies thus have a direct claim against the tax office for reimbursement of the wrongly invoiced VAT which was paid to their suppliers and which they have remitted to the state treasury, including the related interest. Any liquidity disadvantages caused by the improperly invoiced VAT are to be compensated by the payment of interest on arrears. Thus, the CJEU remains consistent in its case law that improperly invoiced VAT and the liquidity disadvantages incurred have to be reimbursed. The principle of neutrality of VAT and the principle of effectiveness require that all liquidity disadvantages be compensated.

Key Takeaways

The recipient of supplies of goods experiences further protection through the consistent application of the Reemtsma claim even in the case of civil law limitation.

This is also consistent with regard to the payment of VAT by the supplier to the state, especially against the background of the supplier's role as a tax collector for the state with regard to VAT.

The German tax authorities will not be able to maintain their restrictive approach regarding the Reemtsma claim following this CJEU decision. In its decision, the CJEU refutes the arguments of the German Federal Ministry of Finance pout forward in the letter in question. An adjustment of the restrictive approach is to be expected. All taxpayers who may be affected should appeal and, if necessary, file applications for equitable relief. In view of the contrary opinion of the CJEU, action within the framework of legal remedies should be promising.

Overall, it is positive that the assertion of the Reemtsma claim should be significantly facilitated for the taxpayer in the future if the opinion of the tax authorities changes.

Do you have further questions in this context? Then do not hesitate and contact the tax law team of DLA Piper. Give us a call or send us an email.