2 March 2023 • 13 minute read

SEC’s proposed expansion of Investment Advisers Act custody rule would impose new burdens on advisers and qualified custodians and impact crypto holders

On February 15, 2023, the Securities and Exchange Commission (SEC) announced a proposal to enhance the protection of customer assets managed by registered investment advisers. The SEC is proposing to redesignate the current custody rule, Investment Advisers Act Rule 206(4)-2, as new rule 223-1 and to amend its provisions as well as certain related recordkeeping and reporting obligations. The SEC’s proposal describes new Rule 223-1 as the safeguarding rule.

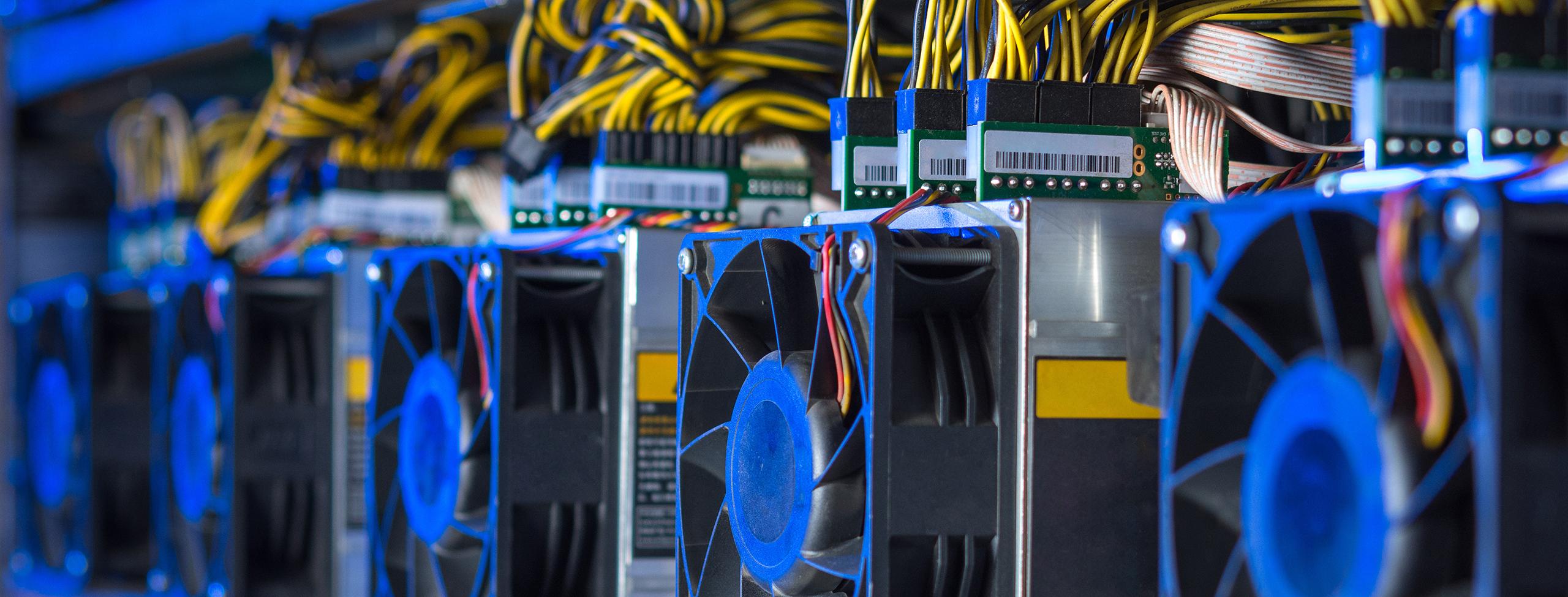

The proposed rule would broaden the application of the current investment adviser custody rule beyond client funds and securities to include any client assets, including previously excluded assets such as crypto and other digital assets, if the investment adviser possesses or has the authority to obtain possession of those assets. Like the current custody rule, the proposed safeguarding rule would entrust safekeeping of the newly expanded scope of client assets to qualified custodians, including, for example, certain banks or broker-dealers.

The proposed rule amendments, if adopted, would have significant impacts on investment advisers and their clients.

Background

Last amended in 2009, the SEC’s custody rule requires investment advisers to keep their customers’ funds and securities with a qualified financial firm or custodian, typically a bank, broker-dealer or trust company. In 2010, Congress, as part of the Dodd-Frank Act, amended the Investment Advisers Act by adding section 223 which provides “[a]n investment adviser . . . shall take such steps to safeguard client assets over which such adviser has custody . . .” That amendment authorized the SEC to issue rules requiring registered advisers to take steps to safeguard any client assets over which an adviser has custody, not simply funds or securities. The SEC is proposing the new safeguarding rule under this authority.

In proposing these amendments, SEC Chair Gary Gensler stated, “investors working with advisers would receive the time-tested protections that they deserve for all of their assets, including crypto assets, consistent with what Congress envisioned.” SEC Commissioner Mark T. Uyeda, however, was less optimistic and noted that the proposed rule would directly impact crypto assets that, by their very nature, trade on platforms that are not qualified custodians. Commissioner Hester Peirce likewise stated that the SEC’s proposed release may “encourage investment advisers to back away immediately from advising their clients with respect to crypto” and appeared to be part “of a broader strategy of wishing complete jurisdiction over crypto into existence.”

Regardless of the potential impact of the proposed rule on various stakeholders, the proposed amendments represent a significant change to the status quo.

The proposed rule

1. Custody and assets covered under the proposed rule

The proposed rule amendments generally would preserve the current rule’s definition of “custody,” and apply when an adviser “holds, directly or indirectly, client assets, or has any authority to obtain possession of them,” ie, when an adviser has the ability or authority to effect a change in beneficial ownership of a client’s assets, which would include any form of discretionary trading authority.

Significantly, the proposed rule broadly defines “assets” subject to the rule as “funds, securities, or other positions held in a client’s account.” The SEC’s proposal is clear that the definition of assets includes investments in crypto assets, even in the instances where such assets are neither funds nor securities, financial contracts held for investment purposes, collateral posted in connection with a swap contract on behalf of the client, and other assets that may not be clearly funds or securities covered by the current rule. Additionally, physical assets, including artwork, real estate, precious metals, or physical commodities, would be within the scope of the proposed rule.

In another change from the current rule, the proposed rule would require that an investment adviser maintain client assets with a qualified custodian that has possession or control of those assets. For the purposes of proposed rule, “possession or control” is defined to mean holding assets such that (i) the qualified custodian is required to participate in any change in beneficial ownership of those assets; (ii) the qualified custodian’s participation would effectuate the transaction involved in the change in beneficial ownership; and (iii) the qualified custodian’s involvement is a condition precedent to the change in beneficial ownership.

With respect to crypto assets, the SEC’s proposing release recognizes “that proving exclusive control of a crypto asset may be more challenging than for assets such as stocks and bonds.” However, the proposed rule’s definition of possession or control turns on whether the qualified custodian is required to participate in a change in beneficial ownership of a particular asset. Therefore, a qualified custodian would have possession or control of a crypto asset if it, for example, generates and maintains private keys for the wallets holding advisory client crypto assets in a manner such that an adviser is unable to change beneficial ownership of the crypto asset without the custodian’s involvement.

To comply with the proposed rule, an adviser with custody of client crypto assets would therefore need to ensure those assets are maintained with a qualified custodian that has possession or control of the assets at all times during which the adviser has custody. For example, a crypto trading platform (that is not itself a qualified custodian) that requires an adviser or client to transfer crypto assets to such an exchange prior to the execution of a trade (eg, as part of the pre-funding or settlement process), would cause an adviser to be in violation of the rule because custody of the crypto would not be maintained by a qualified custodian at all times.

2. Qualified custodians

The proposed rule, like the current rule, would define the term “qualified custodian” to mean a bank or savings association, registered broker-dealer, registered futures commission merchant, or certain foreign financial institutions. The proposed rule would, however, now require that in order to serve as a qualified custodian, a bank or savings association must hold client assets in an account that is designed to protect such assets from creditors of the bank or savings association in the event of the insolvency or failure of the bank or savings association.

Further, noting that “[r]ecent events in crypto assets markets . . . highlighted the need for [] enhanced custody safeguards of client assets held outside the United States,” the SEC will now require a foreign financial institution (“FFI”) serving as a qualified custodian for client assets to:

- Be incorporated or organized under the laws of a country or jurisdiction other than the United States, provided that the adviser and the SEC are able to enforce judgments, including civil monetary penalties, against the FFI

- Be regulated by a foreign country’s government, an agency of a foreign country’s government, or a foreign financial regulatory authority as a banking institution, trust company, or other financial institution that customarily holds financial assets for its customers

- Be required by law to comply with anti-money laundering and related provisions similar to those of the Bank Secrecy Act and regulations thereunder

- Hold financial assets for its customers in an account designed to protect such assets from creditors of the foreign financial institution in the event of the insolvency or failure of the foreign financial institution

- Have the requisite financial strength to provide due care for client assets and

- Be required by law to implement practices, procedures, and internal controls designed to ensure the exercise of due care with respect to the safekeeping of client assets.

Finally, for an FFI to be a qualified custodian, it must not be operated for the purpose of evading the provisions of the proposed rule.

3. New minimum custodial protections

The proposed rule would require that the investment adviser maintain client assets with a qualified custodian pursuant to a written agreement between the qualified custodian and the investment adviser (or between the adviser and client if the adviser is also the qualified custodian). It would further require the adviser to obtain reasonable assurances in writing from the custodian regarding the safeguarding of client assets.

Specifically, an adviser must obtain in writing the following “reasonable assurances” from a qualified custodian:

- Due care: the qualified custodian will exercise due care in accordance with reasonable commercial standards in discharging its duty as custodian and will implement appropriate measures to safeguard client assets from theft, misuse, misappropriation, or other similar types of loss

- Indemnification: the qualified custodian will indemnify the client (and will have insurance arrangements in place that will adequately protect the client) against the risk of loss in the event of the qualified custodian’s own negligence, recklessness, or willful misconduct

- Sub-custodian or similar arrangements: the existence of any sub-custodial, securities depository, or other similar arrangements with regard to the client’s assets will not excuse any of the qualified custodian’s obligations to the client

- Segregation of client assets: the qualified custodian will clearly identify the client’s assets as such, hold them in a custodial account, and segregate them from the qualified custodian’s proprietary assets and liabilities and

- No liens unless authorized in writing: the qualified custodian will not subject client assets to any right, charge, security interest, lien, or claim in favor of the qualified custodian or its related persons or creditors, except to the extent agreed to or authorized in writing by the client.

The written agreement must also contain a number of specific provisions requiring the qualified custodian to: (i) provide records relating to client assets to the SEC or an independent public accountant for purposes of compliance with the rule; (ii) send account statements, at least quarterly, to the client and the investment adviser, with certain specified information; (iii) obtain, at least annually, and provide to the investment adviser a written internal control report that includes an opinion of an independent public accountant as to whether the custodian has suitable and effective controls in place to safeguard the client assets; and (iv) specify the investment adviser’s agreed-upon level of authority to effect transactions in the custodial account as well as any applicable terms or limitations.

4. Assets excepted from qualified custodian requirement

The proposed rule provides an exception to the requirement to maintain client assets with a qualified custodian where an adviser has custody of privately offered securities or physical assets. To qualify for this exception, an adviser must: (i) determine and document that ownership cannot be recorded and maintained in a manner that is consistent with custody by a qualified custodian; (ii) reasonably safeguard the assets from loss; (iii) inform an independent public accountant of any transfers within one day of a transfer and obtain verification of each transfer from that independent public accountant; and (iv) have the existence and ownership of the client’s privately offered securities or physical assets verified through financial statement audit or a surprise examination.

The proposed rule’s definition of privately offered securities would retain the elements from the custody rule’s description that require the securities to be acquired from the issuer in a transaction or chain of transactions not involving any public offering, and transferable only with prior consent of the issuer or holders of other outstanding securities of the issuer. However, the SEC’s proposing release specifically notes that crypto asset securities issued on public, permissionless blockchains would not satisfy the conditions of privately offered securities under the proposed safeguarding rule.

5. Other proposed changes

The proposed amendments would expand the types of entities which can be subject to a financial statement audit in lieu of a surprise examination. For the adviser to qualify for the audit provision under the proposed rule, its client that is a limited partnership (or limited liability company, or another type of pooled investment vehicle or any other entity) would need to undergo a financial statement audit that meets the terms of the rule at least annually and upon liquidation. The proposed rule also contains an exception from the surprise examination requirement for client assets if the adviser’s sole basis for having custody is discretionary authority with respect to those assets and the client assets that are maintained with a qualified custodian.

In addition, the proposed amendments would add new recordkeeping requirements that include: (i) retaining copies of required client notices; (ii) creating and retaining records documenting client accounts; (iii) creating and retaining records concerning qualified custodian, such as, copies of all records received from the qualified custodian relating to client assets; (iv) records indicating the basis of the adviser’s custody of client assets; (v) retaining copies of all account statements; and (vi) retaining copies of any standing letters of authorization. In addition, the proposed amendments would add new recordkeeping requirements to address independent public accountant engagements.

Finally, the SEC proposes to amend Form ADV amendments to align with the proposed rule and provide more specific disclosures of custody related data.

Key takeaways – significant new compliance burdens and impacts on crypto assets

The proposed rule would impose significant new burdens on advisers and qualified custodians which may prove expensive to implement. As the SEC’s proposing release acknowledges, the proposed written agreement between a custodian and an adviser would be “a substantial departure from current industry practice,” and such agreements may be difficult for advisers to obtain and costly for clients. Similarly, the requirement that qualified custodians obtain internal control reports would impose new financial and compliance burdens on custodians. Qualified custodians would also be, among other things, required to provide records related to client assets promptly to the SEC upon request. Reflecting upon these new custodian obligations, Commissioner Peirce commented that, although the SEC does not have authority to regulate custodians directly, the proposed rule seeks to do so indirectly.

Further, while the proposed rule changes are purportedly “asset neutral,” the SEC’s proposing release mentions “crypto” over 200 times and the individual commissioners and Chair have made public statements specifically addressing the rule’s impact on crypto assets. As Commissioner Uyeda noted, the proposed rule may create “a 'no-win' scenario for crypto assets” given such assets often trade on platforms that are not qualified custodians. Thus, the proposed rule, if adopted, could substantially impact advisers and their crypto-asset holding clients and, as Commissioners Peirce and Uyeda cautioned, likely shrink the ranks of qualified crypto custodians and advisers.

Advisers, custodians and investors should carefully consider the proposed rules, and their potential impact. Comments on the proposed amendments must be submitted by May 10, 2023. If you have any questions regarding the proposed rule or the potential impact on your business, please contact any of the authors or your DLA Piper relationship attorney.