22 February 2023

The road to CORRA: Term CORRA benchmark expected by the end of Q3-2023

Results from the Canadian Alternative Reference Rate Working Group’s (“CARR”) May 16, 2022 public consultation showed significant interest in, and the need for, Term overnight Canadian Overnight Repo Rate Average (“CORRA”). On January 11, 2023, CARR announced that the development of 1- and 3-month Term CORRA benchmarks are underway, with the objective of rolling out such benchmarks for use by the end of Q3-2023.

This article provides a summary of the transition from Canadian Dollar Offered Rate (“CDOR”) to overnight CORRA as well as the latest news regarding the development of Term CORRA.

Term CORRA benchmark expected by the end of Q3-2023

The CARR released a white paper in December 2021 recommending that the administrator of the Canadian Dollar Offered Rate, Refinitiv Benchmark Services (UK) Limited (“Refinitiv”), cease publication of CDOR. CDOR is published as a forward-looking term rate, generally for 1-month or 3-month terms. Refinitiv announced that it will cease the publication of CDOR after June 28, 2024. The expectation is that the vast majority of financial products currently referencing CDOR will transition to the overnight CORRA, which is a daily overnight risk-free rate administered by the Bank of Canada. The white paper noted that CARR would consult on a potential forward-looking rate (See our previous article, "The road to CORRA: Sunset on CDOR", for an overview of how the transition to CORRA is expected to proceed).

Results from CARR’s May 16, 2022 public consultation showed significant interest in, and the need for, Term CORRA. On January 11, 2023, CARR announced that the development of 1- and 3-month Term CORRA benchmarks are underway, with the objective of rolling out such benchmarks for use by the end of Q3-2023. CARR decided that a Term CORRA benchmark would help with the transition to overnight CORRA.

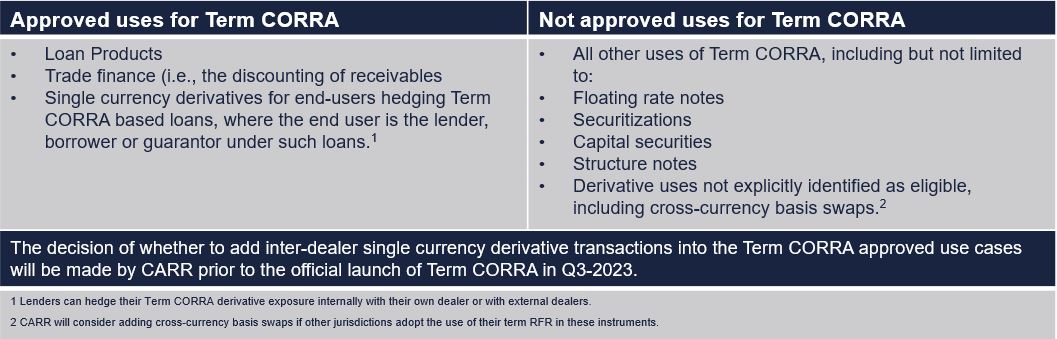

As the expectation is that the vast majority of financial products (or exposure) currently referencing CDOR will transition to overnight CORRA calculated in arrears, the use of Term CORRA will be limited to trade finance (i.e., the discounting of receivables), loans, and derivatives associated with loans through the use of applicable licensing agreements (see table below for more details). Such licensing agreements will be available at a cost that is commercially reasonable to market participants.

Unlike overnight CORRA, which measures the cost of overnight general collateral funding in Canadian dollars using Government of Canada treasury bills and bonds as collateral for repurchase transactions, Term CORRA will be a forward-looking measurement of overnight CORRA for 1- and 3-month CORRA futures trading on the Montreal Exchange.

Subject to all necessary regulatory approvals, Term CORRA will be produced and managed by CanDeal Innovations Inc. as the benchmark administrator in conjunction with TMX Datalinx, the information services division of TSX Inc. CARR expects that Term CORRA and its administrator will be regulated by the Ontario Securities Commission and the Autorité des marchés financiers under Multilateral Instrument 25-102, Designated Benchmarks and Benchmark Administrators (MI 25-102).

More information on the development of Term CORRA, including CARR’s recommended approach for calculating Term CORRA, can be found here.

The long-term and ongoing viability of Term CORRA will depend on the 1-month and 3-month liquidity of underlying CORRA futures contracts being sufficiently robust to meet regulatory expectations. Therefore, CARR recommends and expects any users of Term CORRA to have robust fallback language in place, for example, by referencing overnight CORRA calculated in arrears.

What’s next

Market participants should continue to monitor the development of Term CORRA over the next few months.

For further information on the transition from CDOR to overnight CORRA or the development of Term CORRA please contact the authors or any member of the DLA Piper Canada’s Finance group.