4 February 2025 • 13 minute read

White House Executive Orders impacting tax and trade – developments of the week of January 27, 2025

A range of White House Executive Orders (EOs) are likely to impact tax and trade policy. In this alert, DLA Piper’s Tax and Trade policy team provides updates and insights on relevant policy developments from the week of January 27, 2025, as well as tax planning perspectives to help maximize tax and trade policy positions of interest to company stakeholders.

Notable EOs from the week of January 27, 2025

Last week in taxes

DLA Piper’s President Trump Executive Orders hub sets out executive actions of the new Administration for this week, as well as our coverage of those actions. In this alert, we also link to tax- and trade-specific EOs as well as potential legislation.

As we noted in last week’s communication, the Administration’s Regulatory Freeze EO presents a number of questions regarding its impact on businesses. Our assessment regarding implications of the EO for regulations already published in the Federal Register has been confirmed to be correct by relevant counsel on Capitol Hill, and that assessment has been further borne out in the introduction of initial legislation in the House and Senate from Representative Mike Carey (R-OH) and Senator Ted Cruz (R-FL) using the Congressional Review Act (CRA) process to initiate the process of congressional overturn of certain so-called midnight regulations preceding President Donald Trump’s inauguration.

While the White House cannot simply overturn regulations published in the Federal Register, the following steps noted last week are potential avenues for addressing midnight regulations:

- These regulations have already been published in the Federal Register, but with a future effective date (eg, disregarded payment loss or DPL regulations have a January 2026 effective date):

- Paragraphs 3 and 4 of the regulatory freeze EO are relevant to the tax space, and preliminary alignment on interpretation is as follows:

- In this case, Treasury has 60 days from the date of the EO (ie, January 20, 2025) to take a fresh look at the regulations and, should they so choose, reopen the public comment period. This would afford interested taxpayers another opportunity to provide comments that could lead to change in the regulations in question.

- At this juncture, tax-writing committee counsel on the Hill are aiming to interpret the “methodology” by which OMB and Treasury will evaluate what will receive renewed comments and possible revision and what will not.

- Paragraphs 3 and 4 of the regulatory freeze EO are relevant to the tax space, and preliminary alignment on interpretation is as follows:

Regulations pushed out just prior to January 20, 2025 that have immediate effective dates (for example, 45e regulations): Please see the following (last) paragraph of the EO that reads:

Should actions be identified that were undertaken before noon on January 20, 2025, that frustrate the purpose underlying this memorandum, I may modify or extend this memorandum, to require that department and agency heads consider taking steps to address those actions.

- Capitol Hill tax counsel have noted ambiguity in the above language, which has prompted communication among tax counsel on the Hill, the White House, and the US Office of Management and Budget O(MB)/Treasury (OMB is implicated by the EO for oversight) in an effort to determine the path forward. However, preliminary interpretation of this paragraph suggests that it allows the new Administration to capture regulations pushed out with a pre-January 20, 2025 effective date, thereby affording a pathway to potentially open a public comment period. That period could provide a pathway for changes to regulations with a date already in effect.

- We aim to provide further insight on this, as well as insight into the manner in which the various entities mentioned may determine how to proceed with this process.

Next steps: While we are beginning to see congresspersons introduce legislation leveraging the CRA to overturn regulations, this approach would ultimately require a joint resolution of Congress, which could prove a lengthy process, and one that may be affected by the narrow margins within the House.

We are communicating with relevant senators and representatives on tax-writing committees regarding regulations that have been brought to our attention, and we also aim to discuss the same with personnel in the Department of the Treasury.

Another potential avenue being monitored, as discussed with some tax-writing committee counsel in recent days, is the potential for current regulations at issue to be essentially overwritten via tax legislation. It is still too early to understand whether that would be a viable approach, and we are exploring all avenues. Please let us know your concerns about how these variables may affect your business.

General tax bill updates for the week of January 20, 2025

Reconciliation process and timing: House members returned from a retreat in Doral, Florida with President Trump without a clear consensus on the timing and substance of a reconciliation bill or bills. We do, however, understand that the House is likely to introduce a budget resolution the week of February 3, 2025, which would tee up the process for setting topline spending numbers in advance of the March 14. 2025 debt ceiling deadline, as well as for sending reconciliation instructions to the various committees that set targets for FY 2025 pending levels and for how much each committee is required to cut in order to achieve the budgetary goals and parameters set forth in the larger reconciliation instructions.

Key insight: Can tariffs offset tax bill cost?

We want to briefly comment on some of the public statements made by President Trump and others that tariffs implemented from the Executive Branch can “offset” the cost of a tax bill. Unless tariffs are passed and implemented via the legislative pathway and congressional action, tariff revenue at a basic level cannot be used to offset the score of a tax bill.

Further to this point, there have also been a number of statements in the media as well as during Senate confirmation hearings in which nominees, among them Commerce Secretary Howard Lutnick, acknowledged that imposition of tariffs likely would lead to price increases for American consumers. We also saw comments from Senate Majority Leader John Thune (R-SD) cautioning that his state, which is highly reliant on international trade, would be hit fairly hard with the imposition of tariffs. The larger implications are that many members of Congress regard imposing such tariffs as a politically unstable and unpredictable action, and that Congress would likely be unwilling to act to pass such tariffs legislatively.

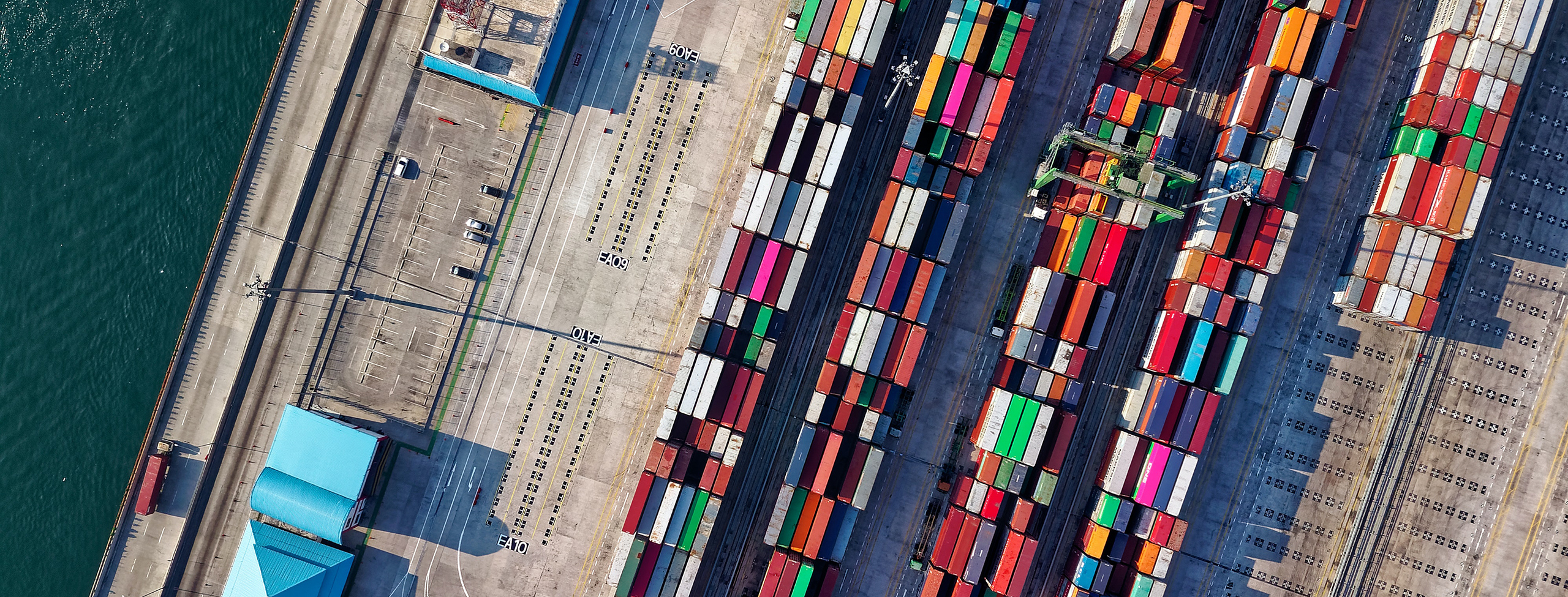

Trade, tariffs, and President Trump

Just hours after his inauguration on January 20, 2025, President Trump issued the American First Trade Policy memorandum, ordering federal agencies to conduct a comprehensive review of US trade policy, with particular attention devoted to US–China trade relations. Most federal agencies have until April 1, 2025 to report their findings and provide recommendations. This only allows about two months for assessments required by the President Trump memorandum on topics such as unfair trade practices, currency manipulation, existing US export controls (particularly in the tech sector), and foreign barriers to trade.

While most of President Trump’s directives under the memorandum require a period of investigation in advance of tariff increases, the International Emergency Economic Powers Act (IEEPA) remains one of the key trade tools available to the President; under the IEEPA, tariffs could be imposed with immediate effect. The IEEPA has historically been deployed to promulgate US economic sanctions (and never, to date, to impose tariffs). To use it to regulate international commerce, there needs to be an “unusual or extraordinary threat” to national security, foreign policy, or the US economy – that is, President Trump could use the IEEPA to impose tariffs if he declares a national emergency.

For example, on January 26, President Trump threatened to impose both economic sanctions and tariffs under the IEEPA against Colombia – a major US ally – for refusing to accept deported migrants; later that day, Colombia reversed its position. The outcome of the tit-for-tat suggests the White House will likely continue to threaten and potentially exercise its emergency powers under IEEPA to impose tariffs to achieve its foreign policy goals.

Most recently, President Trump doubled down on his treat to impose 25-percent tariffs on Canada and Mexico effective February 4, 2025, using IEEPA as the legal basis for the tariffs and declaring a national emergency over fentanyl overdoses and illegal immigration.

Importing companies (not foreign manufacturers) pay tariffs on goods that enter the US, and many expect importers will likely pass the costs to consumers or be forced to accept lower profits. Moreover, counting tariffs as revenue generally requires Congress to vote on them as legislation, so the extent to which tariff revenue may be used to offset tax income remains unclear.

Our National Security and Global Trade team is closely following these developments and remains well positioned to advise clients on how to plan for and respond to the evolving tariff landscape. Learn more about the implications for your business by contacting any of the authors of this alert. For additional details on the America First Trade Policy memorandum, please see this alert. Please also heck out the materials from our webinar on the tax implications of the 2024 US elections.

Key tax/trade bills introduced the week of January 27, 2025

H.R.750 - To amend the Internal Revenue Code of 1986 to provide incentives for education

H.R.761 - To amend the Internal Revenue Code of 1986 to provide for an election to expense certain qualified sound recording costs otherwise chargeable to capital account

H.R.782 - To amend the Internal Revenue Code of 1986 to establish a credit for hired critical employees and to make permanent certain expiring provisions relating to the child tax credit

H.R.802 - To amend the Internal Revenue Code of 1986 to add qualified semiconductor design expenditures to the advanced manufacturing investment credit

H.R.805 - To amend section 321 of the Tariff Act of 1930 to modify the administrative exemptions under that Act

H.R.815 - To amend the Internal Revenue Code of 1986 to extend expensing of environmental remediation costs

S.327 - A bill to amend the Internal Revenue Code of 1986 to deny any foreign tax credit or deduction with respect to taxes paid or accrued to the Russian Federation

S.336 - A bill to amend the Internal Revenue Code of 1986 to exclude from gross income amounts received from State-based catastrophe loss mitigation programs

S.348 - A bill to limit the authority of the President to impose new or additional duties with respect to articles imported from countries that are allies or free trade agreement partners of the US

Key federal communications of note of the week of January 27, 2025

EC180 - A communication from the Director of the Regulations and Disclosure Law Division, Customs and Border Protection, Department of Homeland Security, transmitting, pursuant to law, the report of a rule entitled, "Agreement Between the United States of America, the United Mexican States, and Canada (USMCA) Implementing Regulations Related to Textile and Apparel Goods, Automotive Goods, and Other USMCA Provisions interim final rule" (RIN1685-AA00) received in the Office of the President of the Senate on January 17, 2025; to the Committee on Finance

EC182 - A communication from the Chief of the Publications and Regulations Branch, Internal Revenue Service, Department of the Treasury, transmitting, pursuant to law, the report of a rule entitled, "Section 45Y Clean Electricity Production Credit and Section 48E Clean Electricity Investment Credit" (RIN1545-BR17) received in the Office of the President of the Senate on January 17, 2025; to the Committee on Finance

EC183 - A communication from the Chief of the Publications and Regulations Branch, Internal Revenue Service, Department of the Treasury, transmitting, pursuant to law, the report of a rule entitled, "Classification of Digital Content Transactions and Cloud Transactions" (RIN1545-BM41) received in the Office of the President of the Senate on January 17, 2025; to the Committee on Finance

EC184 - A communication from the Chief of the Publications and Regulations Branch, Internal Revenue Service, Department of the Treasury, transmitting, pursuant to law, the report of a rule entitled, "Rules Regarding Certain Disregarded Payments and Dual Consolidated Losses" (RIN1545-BQ72) received in the Office of the President of the Senate on January 17, 2025; to the Committee on Finance

EC185 - A communication from the Chief of the Publications and Regulations Branch, Internal Revenue Service, Department of the Treasury, transmitting, pursuant to law, the report of a rule entitled, "Resolution of Federal Tax Controversies by the Independent Office of Appeals" (RIN1545-BP72) received in the Office of the President of the Senate on January 17, 2025; to the Committee on Finance

EC186 - A communication from the Federal Register Liaison, Internal Revenue Service, Department of the Treasury, transmitting, pursuant to law, the report of a rule entitled, "Micro-captive Listed Transactions and Micro-captive Transactions of Interest" (RIN1545-BQ44) received in the Office of the President of the Senate on January 17, 2025; to the Committee on Finance

EC268 - A communication from the Chief of the Publications and Regulations Branch, Internal Revenue Service, Department of the Treasury, transmitting, pursuant to law, the report of a rule entitled, "Automatic Consent for Revocation of Section 831(b) Elections" (Rev. Proc. 2025-13) received in the Office of the President of the Senate on January 27, 2025; to the Committee on Finance

EC269 - A communication from the Chief of the Publications and Regulations Branch, Internal Revenue Service, Department of the Treasury, transmitting, pursuant to law, the report of a rule entitled, "Domestic Content Bonus Credit Amounts under the Inflation Reduction Act of 2022: First Updated Effective Safe Harbor modifying Notice 2024-41" (Notice 2025-8) received in the Office of the President of the Senate on January 27, 2025; to the Committee on Finance

Learn more

We look forward to bringing you timely updates in the near future. To learn more about these rapidly evolving developments, please contact Evan Migdail, Melissa Gierach, or Steve Phillips, and please also check out the materials from our webinar on the tax implications of the 2024 US elections.