21 December 2022 • 1 minute read

Preparing your Ontario Transparency Register for January 1, 2023

Effective January 1, 2023, private Ontario corporations are required to prepare and maintain a register of “individuals with significant control” (“ISCs”) over the corporation (the “Transparency Register”). These new amendments to the Ontario Business Corporations Act (the “OBCA”) were introduced in November 2021 through Bill 43, Build Ontario Act (Budget Measures), 2021, which received royal assent on December 9, 2021.

The Transparency Register requirements reflect Ontario’s push towards enhancing transparency around corporate ownership and control and can assist law enforcement in targeting money laundering, tax evasion and other illicit activities.

The Transparency Register requirements are similar to those enacted for federally incorporated corporations in 2019 and the requirements of the Provinces of British Columbia, Québec, Saskatchewan, Manitoba, Nova Scotia, PEI, and Newfoundland and Labrador.

Who must maintain a Transparency Register?

All private Ontario corporations must prepare and maintain a Transparency Register other than a wholly-owned subsidiary of a public corporation.

Who is an Individual with Significant Control?

Under section 1.1 of the OBCA, an ISC is:

- the registered or beneficial owner of, or has direct or indirect control or direction over, any number of shares that carry 25 percent or more of the voting rights attached to all of the corporation’s outstanding voting shares;

- the registered or beneficial owner of, or has direct or indirect control or direction over, any number of shares that is equal to 25 percent or more of all the corporation’s outstanding shares measured by fair market value;

- an individual who has direct or indirect influence that, if exercised, would result in “control in fact” of the corporation; or

- an individual to whom circumstances prescribed by regulation apply.

What is “control in fact”?

When considering whether an individual has direct or indirect influence that, if exercised, would result in “control in fact”, one should consider the following:

- all factors that are relevant in the circumstances; and

- the relevant factors should not be limited to, and do not need to include, whether the individual has a legally enforceable right or ability to effect a change in the board of directors or its powers, or to exercise influence over the shareholder(s) who have that right or ability.

Subsection 1.1(5) further defines “control in fact”, stating that specific or similar arrangements do not single-handily constitute “control in fact”. Specifically, “control in fact” is not established when a corporation and the individual are dealing with each other at arm’s length, and the influence originates from the below arrangements, and the primary purpose of those arrangements is to govern the relationship between the corporation and the individual regarding how a business carried on by the corporation is conducted:

- franchise;

- license;

- lease;

- distribution;

- supply;

- management; or

- similar agreements or arrangements.

What happens when two or more individuals are an ISC?

Subsection 1.1(4) of the OBCA addresses situations where two or more individuals jointly or collectively hold or exercise rights or interests in a corporation. Specifically, two or more individuals are each considered to be an ISC in the following circumstances:

- they jointly hold rights, interests, or combinations of rights or interests in the corporation, meeting the 25 percent threshold;

- they are parties to an agreement or arrangement whereby the parties agree to exercise any rights that they hold in the corporation “jointly or in concert”, and those rights and interests meet the 25 percent threshold; or

- the individual holding the ownership interest, rights, or combinations of rights and interests, meeting the 25 percent threshold, are “related persons”. This includes spouses, children and possibly relatives if they live in the same home.

What should be included in the Transparency Register?

The Transparency Register must include the following information for each ISC:

- their name, date of birth, and last known address;

- their jurisdiction of residence;

- the day on which each ISC became and ceased to be an ISC;

- a description of how each ISC is an individual with significant control, including a description of their interests and rights in respect of the shares of the corporation; and

- any other prescribed information that may be required under regulations.

The Transparency Register must also include a description of each reasonable step taken (once each financial year of the corporation) to ensure that all ISCs have been identified and that the Transparency Register’s information is accurate, complete and up-to-date.

The corporation is responsible for updating the Transparency Register at least once each financial year. The corporation must take reasonable steps in accordance with the regulations to ensure that it has identified all individuals with significant control and that the information in the register is accurate, complete, and up-to-date. If the corporation becomes aware of any new information, it must update the register within 15 days after becoming aware of the new information.

Under subsection 140.3(5), if the corporation requests information from one of its shareholders, the shareholder shall promptly and, to the best of their knowledge, reply accurately and completely.

When can a corporation dispose the personal information?

The Corporation must dispose of any personal information of an ISC within one year after the sixth anniversary of the day on which the ISC ceases to have significant control over the corporation.

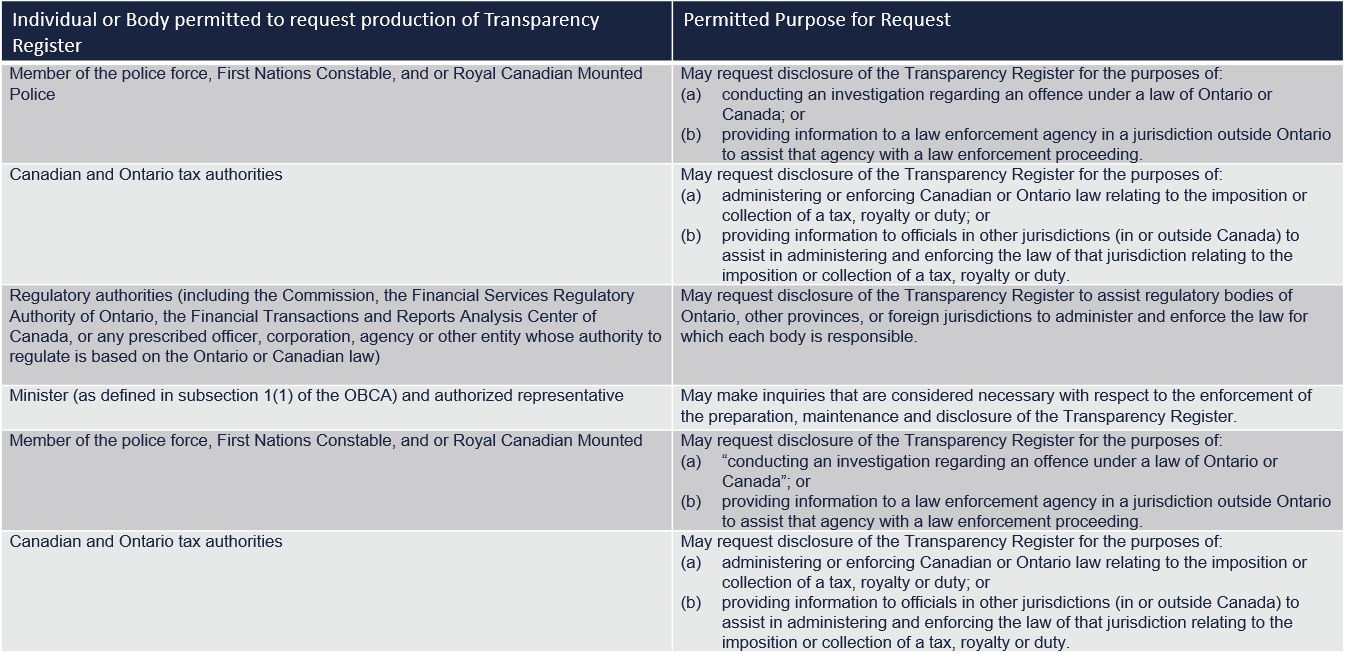

Who can access the Transparency Register?

The Transparency Register must be kept at the corporation’s registered office in Ontario unless the corporation’s directors designate another Ontario location. However, the individuals and bodies below may request a corporation to disclose its Transparency Register for varying purposes.

The corporation must respond to the request within the time period specified in the request, and the response must comply with prescribed requirements, conditions or restrictions.

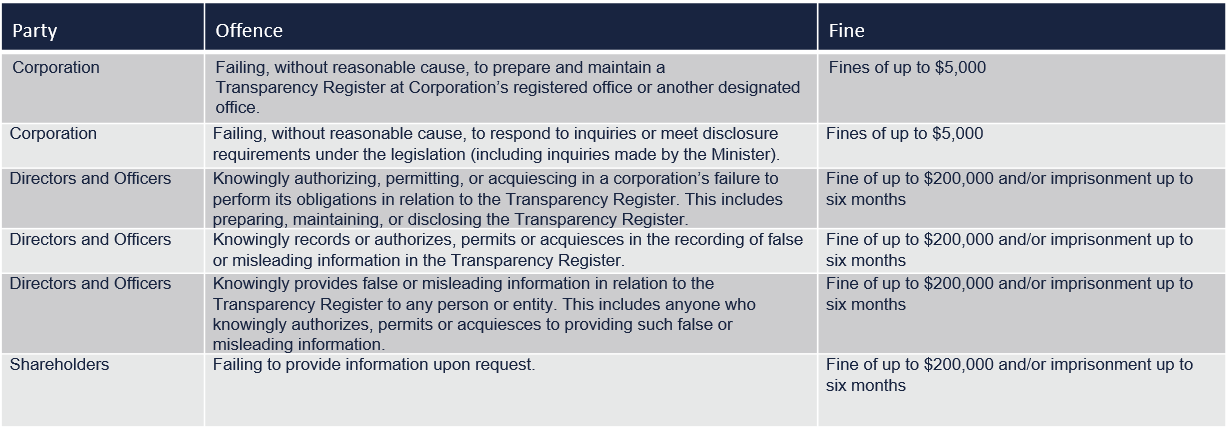

Enforcement

The OBCA sets out the following offences and fines in respect of failure to comply with the Transparency Register requirements:

Please feel free to contact the authors or any member of the DLA Piper (Canada) Corporate team if you have any questions about Transparency Registers or the OBCA amendments.