19 May 2023 • 25 minute read

Digital Transformation: eSignature and ePayment News and Trends - 19 May 2023

Achieving Digital Transformation and Securing Digital AssetsToday’s ever-shifting business environment means that consumers, businesses, employers and employees all expect to transact digitally. To remain efficient and competitive, companies must digitally transform their businesses. Successful transformation and maintenance require careful planning and up-to-date knowledge to ensure smooth integration with existing business technology, positive customer experience and ongoing regulatory compliance.

This newsletter includes legal insights and brief summaries of recently enacted federal and state laws, federal and state regulatory activities, fresh judicial precedent and other important news to keep you up to date in the ever-evolving electronic environment.

If you’d like to discuss one of these items, or a project you’re considering, please reach out to one of the editors – and, if there is a topic you’d like us to cover in a future Insight, we’d love to hear from you.

INSIGHT

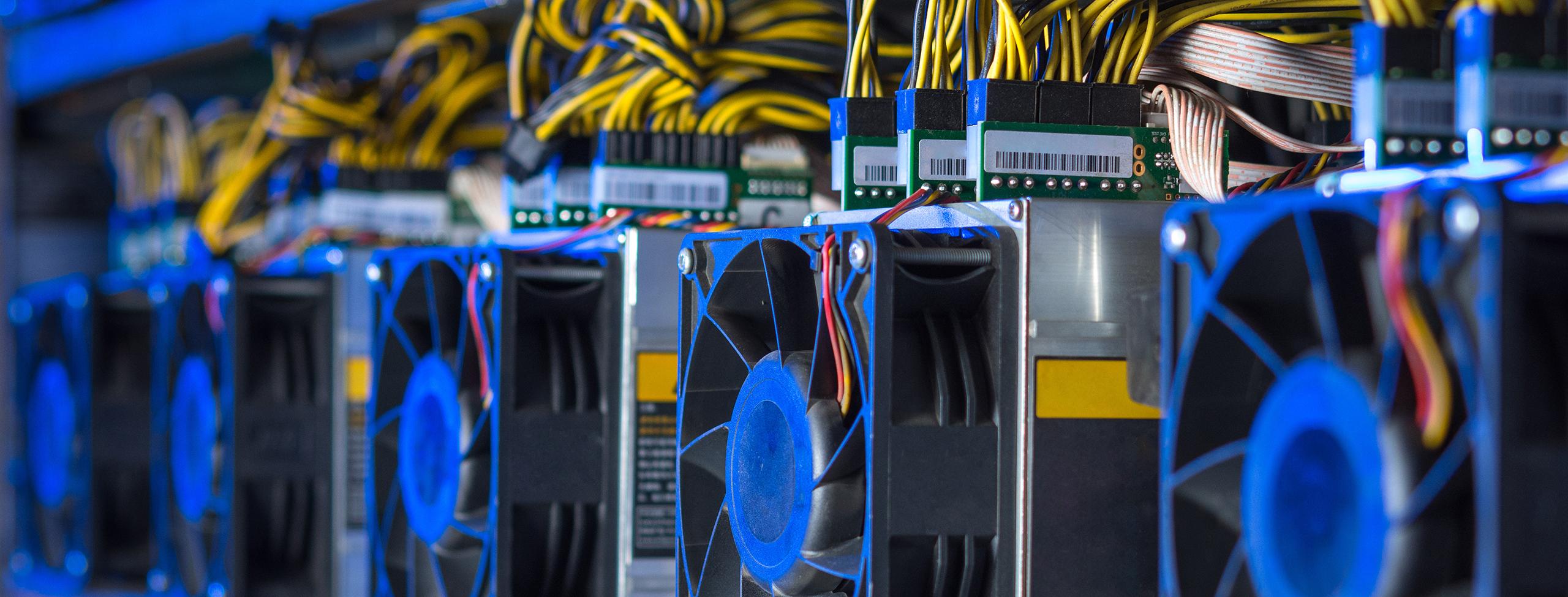

Virtual currency platform operators may be subject to EFTA and Regulation E

By Margo H.K. Tank, R. David Whitaker, Liz Caires, and Emily Honsa Hicks

In Rider et al. v. Uphold HQ, Inc. (2023 WL 2163208, USDC, SDNY, February 22, 2023), the plaintiffs brought a class action asserting claims, among others, for violation of the Electronic Fund Transfer Act (EFTA) and its implementing regulations (Regulation E), against the operator of a cryptocurrency exchange as the result of improper access to the plaintiffs' account by unauthorized actors.

In response to the defendant's motion to dismiss, the court held that cryptocurrencies constituted "funds" within the meaning of the EFTA, enabling plaintiffs to proceed with their claim for violation of the EFTA and claim for negligence per se based on violation of the EFTA. Read more.

Illinois Supreme Court construes BIPA damages

By Margo H.K. Tank, R. David Whitaker, Liz Caires, Emily Honsa Hicks and Ken Knight

Recently, the Illinois Supreme Court addressed the question of whether claims under sections 15(b) and 15(d) of the Illinois Biometric Information Privacy Act (BIPA) accrue each time a private entity scans a persons' biometric identifier and each time that entity transmits the scan to a third party. The case of Cothron v. White Castle System, Inc. (2023 IL 128004, February 17, 2023) was decided 4-3 on certification from the US Court of Appeals for the Seventh Circuit, and held that a separate claim for damages accrues each time an entity collects or transmits an individual's biometric data without BIPA-compliant consent. Read more.

Action on 2022 amendments to the Uniform Commercial Code – South Dakota governor vetoes act

By Margo H.K. Tank, R. David Whitaker, Liz Caires, and Emily Honsa Hicks

According to the Uniform Law Commission, the 2022 Amendments to the Uniform Commercial Code (UCC) have been introduced in approximately 21 states and adopted in the following states:

- North Dakota HB1082 (eff. August 1, 2023)

- New Mexico HB90 (eff. Jan. 1, 2024)

- Colorado SB23-090 (eff. August 7, 2023)

- Indiana SB468 (eff. July 1, 2023) and

- Washington SB5077 (on the governor's desk for signature, eff. January 1, 2024 once signed)

Variations on portions of the 2022 Amendments have been previously adopted in several states, including Idaho, Iowa, Nebraska, Indiana, Arkansas, New Hampshire, Texas, and Wyoming, although not all are effective yet.

On March 9, South Dakota Governor Kristi Noem vetoed House Bill 1193, which would have adopted the 2022 Amendments, including UCC Article 12, as part of the South Dakota UCC. Read more.

REGULATORY DEVELOPMENTS

FEDERAL

USPTO

US patents to be electronically granted. Patent grants are now issued electronically by the United States Patent and Trademark Office (USPTO) as of April 18, 2023, pursuant to regulatory amendments proposed/announced in December 2021 and more fully explained in a February 28, 2023 notice. These “eGrants” will be issued under a new digital seal containing the USPTO Director's digital signature that will conform with 35 U.S.C. 153. That regulation requires patents to be issued under the USPTO's seal and contain the Director's signature – "An encrypted digital signature that may be used to validate the electronic patent document as the issued patent will be embedded within the seal." The USPTO anticipates that the move will shorten the issuance time and save paper, and such patents will be available on Patent Center on the issuance date, and notes that USPTO efforts to modernize the process began as early as 2001, when they enabled electronic filing. Prior patents will not be converted to eGrants, and ceremonial paper copies will be available. USPTO already began issuing trademark registrations electronically, beginning in May 2022.

Digital assets

Biden Administration issues annual economic report which doubts future of digital assets. On March 20, the Biden Administration released the 2023 Economic Report of the President. Section 8 of the report is entirely devoted to digital assets and asserts that many of the potential benefits of such assets have yet to materialize. The report lists and describes the following claimed benefits of cryptoassets: use as investment vehicles, function as money without reliance on a single authority, facilitation of fast digital payments, support for financial inclusion, and improvement of US FinTech infrastructure. The report then states that, in reality, cryptoassets offer none of these benefits, and it goes on to describe cryptoassets as speculative, volatile, risky, and without any underlying value, and cryptocurrencies as failing in broad acceptance as a medium of exchange – in part because even stablecoins tend to be risky and subject to runs. The report laments that cryptoasset risk has been difficult to mitigate with regulation.

IRS

IRS issued final regulations on electronic filing for businesses. The Internal Revenue Service issued final regulations (T.D. 9972) on February 21, pursuant to the Taxpayer First Act that will require certain business filers to e-file returns beginning in 2024. Affected filings include “partnership returns, corporate income tax returns, unrelated business income tax returns, withholding tax returns, certain information returns, registration statements, disclosure statements, notifications, actuarial reports and certain excise tax returns.” The final regulations reduce the return threshold to 10 or more (from 250) and require most information return types to be aggregated for purposes of the threshold, and they eliminate the exception for corporations with total reportable assets under $10 million, among other changes. 1099 series information returns can be filed via a new, free IRS online portal, the Information Returns Intake System (IRIS).

CFPB

CFPB issues RESPA advisory opinion re digital marketing risk. The Consumer Financial Protection Bureau (CFPB) announced the release of an advisory opinion on February 7 which warns operators of digital mortgage comparison-shopping platforms of specific practices the CFPB views as violative of the Real Estate Settlement Procedures Act (RESPA). RESPA Section 8 prohibits the payment of fees for the referral of real estate settlement services. The advisory opinion cautions operators against presenting information on their platforms in a non-neutral way or otherwise "steer[ing] shoppers to lenders by using pay-to-play tactics" which favor preferred providers that pay the platform a referral fee.

SEC

SEC publishes proposed rules enabling electronic filing and electronic signatures on additional documents. On April 18, the Securities and Exchange Commission (SEC) published proposed rules which, among other things, require electronic filing or submission of certain forms and other filings or submissions that are required to be filed with or submitted to the Commission, remove the manual signature requirements for self-regulated organization proposed rule change filings, and allow electronic signatures in certain broker-dealer filings. The public comment period closes on May 22.

Department of State

DOS publishes interim final rule enabling use of digital signatures for certain Exchange Visitor Program forms. On March 28, the Department of State published interim final rules for Exchange Visitor Program regulations to allow sponsors to use digital signature software to sign certain VISA forms and electronically transmit such forms. Supplementary information included with the rules defines digital signatures as "An application of technology for cryptographically derived signatures that ensures meaningful authentication of the identity of the signer and integrity of the document. Digital signatures are a subset of electronic signatures, but unlike other electronic signatures, digital signatures employ cryptography, ie, are backed by a process such as a public key infrastructure." Comments on the interim final rules close on May 30.

Department of Health and Human Services

HHS proposes standards for electronic signatures in health care attachments transactions. On March 24, 2023, the Department of Health and Human Services extended the public comment period for response to its proposed rules for the use of electronic signatures in the contexts of health care attachment transactions. Comments were due by April 21. Although the rules permit the use of electronic signatures, the rules require that such signatures conform to a specific standard, the HL7 Implementation Guide for CDA Release 2: Digital Signatures and Delegation of Rights. Only digital signatures created using digital certificates issued to individual signatories comply with this standard. Additionally, the proposed rules are unclear as to whether the underlying clinical notes and medical records later submitted in support of a claim must be signed using only electronic signatures compliant with the standard, or if only the submission itself must be so signed.

STATE

Virtual currency

New York DFS issues industry guidance on custody practices for virtual currency. The New York Department of Financial Services (NYDFS) has issued industry Guidance on Custodial Structures for Customer Protection in the Event of Insolvency for all entities licensed under New York's BitLicense law. The January 2023 guidance outlines how customer assets should be custodied using segregated accounts and separate accounting, terms for sub-custody arrangements, customer disclosures, and the custodian's limited interest in the custodied assets.

Wyoming enacts Stable Token Act. The Wyoming Stable Token Act, SF0127, was signed and became effective on March 17. The Act establishes a Wyoming Stable Token Commission and authorizes the issuance of Wyoming Stable Tokens which are convertible 1:1 into US dollars. The Act transferred $500,000 to the Commission for its administration account to support the Act and requires the Commission to issue at least one stable token by December 31, 2023.

Montana updates virtual currency and digital asset laws. Montana enacted SB0178 on May 2 which revises the state cryptocurrency laws, supports digital asset mining, prohibits taxation on the use of cryptocurrency as a payment method, and amends the Montana Code - Property Title to establish digital assets as personal property. The bill defines digital assets as "cryptocurrencies, natively electronic assets, including stable coins and nonfungible tokens, and other digital-only assets that confer economic, proprietary, or access rights or powers."

Money transmission

Arkansas confirms digital asset mining is not money transmission. On January 10, Arkansas enacted HB1799/Act 851 on April 13, clarifying regulation of digital asset mining businesses and confirming that persons engaged in home digital asset mining or that have a digital asset mining business shall not be considered money transmitters under the Uniform Money Services Act, § 23-55-101 et seq.

Remote online notarization

SECURE Notarization Act passes US House. On February 27, HB1059, the SECURE Notarization Act, passed the US House of Representatives and is awaiting approval in the Senate. If adopted by the Senate and signed into law by President Biden, the SECURE Notarization Act would enable a notary public commissioned under state law to remotely notarize electronic records and perform notarizations for remotely located individuals in all US states. These remote notarial acts may be conducted using electronic records and electronic signatures or using paper and handwritten signatures. The Act provides technical requirements for the remote notarizations, including the creation and retention of video and audio recordings and the use of communication technologies. The Act also requires US courts and states to recognize notarizations – including remote notarizations of electronic records and notarizations performed for remotely-located individuals – that occur in or affect interstate commerce and are performed by a notary public commissioned under the laws of other states.

Status of RON states. To date, 43 states and the District of Columbia have adopted versions of remote notarization which include remote online notarization or RON (remote online notarization which uses electronic records and electronic signatures). Two additional states have adopted remote ink notarization or RIN (remote notarization using paper and handwritten signatures). Of the remaining five states, some still have in place effective COVID-19 emergency laws or orders which permit some form of remote notarization, and California and Connecticut have bills pending to adopt one or more forms of remote notarization. If the SECURE Notarization Act is adopted at the federal level, it will pre-empt state adoptions of remote notarization to the extent the state law conflicts with the Act or the Revised Uniform Law on Notarial Acts.

The most recent state to enact RON is Massachusetts, which enacted H58 to be effective January 1, 2024. Illinois has also proposed RON regulations, which are required before the state RON law may become effective. See pg. 2984 of Illinois Register Vol 47. The proposed regulations are nearly 100 pages long and include stringent requirements for RON platform providers.

Electronic signatures

Kansas supports use of electronic signatures by entities. On April 20, the Kansas governor approved SB244 which updated the state general corporations code, business entity transactions act, and other laws to allow for and facilitate the use of electronic signatures and records in documents related to entity formation and operations.

Digital driver's licenses and eregistrations

Montana adopts digital driver's license. Effective April 26, Montana HB0519 authorizes the use of digital driver's licenses in addition to physical licenses. Montana also enacted a companion bill, SB0396, effective May 1, which provides that displaying a digital driver's license on an electronic device (or handing the device to a peace officer) does not constitute a search or a seizure of the device.

States enable certain auto transfers using esignatures. The following bills were enacted to permits documents transferring ownership of a vehicle to an insurer as part of a total loss claim to be executed using electronic signatures and without notarization:

- Oklahoma SB753 was signed by the governor on May 2 and becomes effective November 1, 2023

- New Mexico SB68 was signed March 16 and becomes effective 90 days after adjournment of the legislature

- South Dakota SB42 was signed on March 9 and enables a power of attorney used in such a transfer to be executed using an electronic signature and without notarization. The bill becomes effective 90 days after adjournment of the legislature

West Virginia DMV adopts electronic signatures for vehicle registration. On March 11, the governor of West Virginia signed SB205 which, among other things, authorizes the Division of Motor Vehicles to accept or authorize electronic signatures in connection with vehicle registrations. The new law becomes effective on June 6, 2023.

INDUSTRY

NIST publishes digital signature standards. On February 3, the National Institute of Standards and Technology (NIST) published FIPS 186-5 Digital Signature Standard (DSS) which specifies a suite of algorithms that can be used to generate a digital signature and support non-repudiation of such signature by the signer.

CASE LAW

FEDERAL

ADA

Court dismisses website ADA compliance complaint as moot. In Tavarez v. Extract Labs, Inc. (2023 WL 2712537, USDC, SDNY March 30, 2023), the court held that the plaintiff's claims of failure of the defendant's website to comply with the Americans with Disabilities Act (ADA) and the Web Content Accessibility Guidelines (WCAG) version 2.1 with respect to the visually impaired are dismissed as moot. The court specifically found that the defendant met its "formidable burden" with the presentation of affidavits demonstrating that "it is 'absolutely clear the alleged wrongful behavior could not reasonably be expected to recur.'" The affidavits detailed the defendant's voluntary compliance measures, including:

- Implementation of an audit processes to identify website issues relating to plaintiff's allegations, with examples of the audit findings

- A complete website redesign to comply with WCAG 2.1

- Resolution efforts by defendant's employees to address the identified issues

- Purchase of a subscription which "continually monitors" WCAG developments and provides "24-hour automatic maintenance scans of new and updated content to be sure there are no accessibility issues"

- Hiring of a contractor who is an expert in WCAG 2.1 guidelines to remedy any other emergent issues.

California district court declines supplemental jurisdiction over ADA-related state law accessibility claims. The plaintiff in Jimenez v. Venice Breeze Suites, LLC et al. (2023 WL 2626956, USDC, CD Calif. January 12, 2023), asserted a claim for injunctive relief arising out an alleged violations of the ADA and other "construction-related accessibility claims" to obtain monetary damages under the California Unruh Civil Rights Act. However, the court declined to assert supplemental jurisdiction over plaintiff's accessibility claims under the Unruh Act and state law after consideration of plaintiff's response to the court's order to show cause. In declining to exercise jurisdiction over plaintiff's state law claims, the court cited the ability of plaintiffs to choose federal court to circumvent California's:

- Heightened pleading standards and verification requirements for disability discrimination lawsuits alleging "construction-related accessibility claim(s)"

- Additional requirements imposed on "high frequency litigants" (which extends to attorneys) such as an additional filing fee of $1,000 and requirements that the complaint include allegations of additional facts

FCRA

Court dismisses claim alleging FCRA violations in online disclosures. The plaintiff in Wynn v. United Parcel Service, Inc. (2023 WL 2324288, USDC, ND Calif., March 1, 2023) alleged the defendant violated the Fair Credit Reporting Act (FCRA) by including "extraneous" information in the FCRA disclosure on defendant's employment application website. The court granted defendant's motion to dismiss without leave to amend the complaint, finding that:

- A checkbox agreement in the disclosure form did not violate FCRA where the checkbox required plaintiff to "acknowledge that her 'electronic signature is the legally binding equivalent to [her] handwritten signature' and that she had reviewed and understood 'this Agreement,' " before authorizing defendant to obtain the credit report.

- The disclosure was clear and conspicuous and did not contain prohibited "extraneous information" despite the webpage frame including "external" links at the bottom of the page and to social media platforms, and tabs at the top of the page.

DAOs

Court refuses to dismiss claims against Ookie DAO. The plaintiffs in Sarcuni et al. v. BZX DAO et al. (2023 WL 2657633, USDC, SD Calif. March 27, 2023) alleged that the plaintiffs were injured by the defendants' negligence in connection with a phishing attack which led to the theft of $55 million in cryptocurrency. The defendants filed motions to dismiss the complaint. Notably, the court denied the defendants' motion to dismiss to the extent based on the platform Terms of Use which were displayed on the website registration page as a hyperlink at the bottom of the page (ie, browsewrap) and, thus, were not enforceable. The Terms of Use hyperlink was visible only if the user scrolled through other material and information and was displayed in small font located below at least 18 other hyperlinks. For additional information on the Sarcuni opinion, see our April issue of Blockchain and Digital Assets News and Trends.

Electronic signature and online contract formation

- Soucie v. Virginia Utility Protection Service, Inc., d/b/a "VA 811" (2023 WL 2991487, USDC, WD Va. Roanoke, April 18, 2023) – An employee was held to have assented to arbitration agreement with the employer by clicking "Mark as Read" on software platform because the agreement's plain language described this process as the express way to "sign and acknowledge" the agreement.

- Snow, et al. v. Nectar Brand, LLC (2023 WL 2558544, USDC, CD Calif., March 2, 2023) – The defendant online retailer obtained a grant of motion to compel arbitration based on conspicuous website terms and conditions containing the arbitration clause, despite a pre-checked checkbox with a hyperlink to Terms and Conditions, because the text for the hyperlink was in the same font size and color as other text on the page, which featured a uniform white background with a lack of clutter, and the checkbox was located directly above the "call to action" "place order" button.

- Lee v. Panera Bread Company (2023 WL 2606611, USDC ED Mich. Northern Div., March 6, 2023) – The defendant's motion to compel arbitration was granted based on website design informing the plaintiff, using gray text above the "Start My Subscription" button, that "By clicking the 'Start My Subscription' button below, you agree that you will be enrolled in a monthly... subscription [and] … [y]ou further agree to Panera's Terms and Conditions…." The phrase Terms and Conditions appeared as a green underlined hyperlink which, when clicked, opened to the first page which stated in bold and uppercase type that the Terms and Conditions were subject to arbitration.

- Romano v. Blue Cross Blue Shield of Michigan d/b/a BCBSM (2023 WL 3197029, USDC, ED Mich. Southern Div., May 2, 2023) and Housepian v. Blue Cross Blue Shield of Michigan (2023 WL 3186946, USDC, ED Mich. Southern Div., May 1, 2023)– In nearly identical cases, a defendant's motion to compel arbitration was denied for failure to present documentation evidencing the employee's electronic signature assenting to arbitration procedure. Evidence that the arbitration procedure was "available" on the defendant employer's website was insufficient without evidence that the employee was directed to review the procedure or that continued employment would convey his agreement to it.

- Nob Hill Catering, Inc. v. Back of the House LLC (2023 WL 3149260, USDC ND Calif., March 16, 2023) – The defendant's motion to transfer venue was denied since the defendant's website presenting its terms of service as a hyperlink at the footer of each page (ie, "browsewrap") was insufficient to provide constructive notice to the plaintiff of the embedded forum selection clause.

- Gaker v. Citizens Disability, LLC (2023 WL 1777460, USDC, D Mass., February 6, 2023) – On cross-motions for summary judgment, the defendant was held not to have obtained the plaintiff's consent under the TCPA for marketing calls and text due to website failure to provide "clear and conspicuous disclosure." The court held that "the website plainly does all that it can to divert the user's attention away from the terms" by presenting the disclosure language:

- Below the data entry fields and the large "call to action" button labelled "CONFIRM YOUR ENTRY"

- At the very bottom of the webpage, which the user must scroll down to view

- In small, fine font, in navy blue font on a royal blue background where text above the "call to action" button was larger and "in colors that distinctly contrasted from the background"

- Below the data entry fields and the large "call to action" button labelled "CONFIRM YOUR ENTRY"

- Martin v. Liberty Mutual Insurance Company (2023 WL 2588165, USDC ED Pa. March 20, 2023) – An electronically signed policy waiver was proven by evidence of copies of the forms showing electronic signatures, the parties' electronic payments and communications, the parties' email and IP address used to electronically sign, and time stamps showing that the parties' viewed and electronically signed the forms within a few hours.

- Everett, Administrator for the Estate of Marion Newsome v. Accordius Health at Creekside Care, LLC (2023 WL 2816895 USDC, ED NC, Northern Div., April 6, 2023) – The defendant's motion to compel arbitration was denied without prejudice to allow the parties to conduct limited discovery to resolve disputed facts regarding the ability of Ms. Newsome to electronically sign an arbitration agreement in light of her physical condition – she is 83 years old, recently suffered a stroke, has been diagnosed with quadriplegia and has a history of hypertension and Parkinson's Disease.

- Capps v. JPMorgan Chase Bank, N.A., et al. (2023 WL 3030990, USDC, ED Calif., April 21, 2023) – The defendant's motion to compel was granted because the website features conspicuous online terms of use, by displaying "immediately above" the "Create Your Account" button the phrase, "I accept and agree to your Terms of Use Agreement…" which was in bolded text with the phrase "terms of use" in a blue underlined hyperlink.

STATE

Money transmission

North Dakota enters consent order with FTX on money transmission. On March 2, the North Dakota Department of Financial Institutions (DFI) announced it had signed a Consent Agreement and Order with West Realm Shires Services, Inc. d/b/a FTX US. According to the order, FTX agreed to a suspension of the money transmitter license granted by the state. The order expressly does not prohibit FTX from returning fiat currency or cryptocurrency assets to North Dakota residents or allowing state residents to withdraw fiat currency or cryptocurrency assets from their FTX accounts. The suspension shall remain in place until lifted by written notice of the DFI. FTX agreed to the order without admitting or denying the allegations.

RECENT EVENTS

Margo Tank will be presenting at NFT Legal Deep Dive: Copyright, trademark, and Uniform Commercial Code (Articles 2 & 12) [Part II], May 17, 2023, 12:00 – 1:00 pm Eastern Time, with Mark Radcliffe and Gina Durham.

Margo Tank and David Whitaker co-presented at the Electronic Signatures and Records Association (ESRA) Spring Member Meeting, held April 25-26 at the Washington, DC offices of DLA Piper LLP. They presented the Legal Update and Regulatory Review, a summary of key legal developments affecting electronic signatures and records, and which covered digital asset regulation, contract issues for digital assets platform providers, recent judicial and regulatory activity affecting digital assets, and state adoption of UCC Article 12.

Margo Tank and David Whitaker co-presented on March 15, 2023, a Federal Bar Association webinar "New UCC Article 12 and Transfers of Interests in Digital Assets." The webinar explored the expanding world of digital assets and current law governing the ownership and transfer of interests in digital assets. It also explored the potential impact of new Article 12 of the Uniform Commercial Code, which has just been approved by the Uniform Law Commission and is being considered for adoption by many states.

DLA Piper ranked in 2023 Chambers FinTech Guide. DLA Piper is pleased to announce that the firm's FinTech Legal practice has been ranked nationwide by the prestigious legal publisher Chambers and Partners. Margo Tank and David Whitaker both received individual FinTech rankings. Overall, the firm received 21 practice rankings and 16 individual lawyer rankings in the Chambers FinTech 2023 edition.

DLA Piper’s Commodities, Digital Assets, and Carbon Compliance and Enforcement team draws on decades of collective experience in the commodities and securities industry to help companies navigate new and complex commodities enforcement matters, including those related to agriculture, metals, energy, digital assets, and carbon/sustainable commodities, among others.

RECENT PUBLICATIONS

Terms of Service Are Instrumental in Determining Rights to Digital Assets – The Holding in Celsius Network LLC, published in The Computer & Internet Lawyer, May 2023, by Margo H.K. Tank, David Whitaker, Liz Caires and Emily Honsa Hicks.

Cryptocurrency and Digital Asset Regulation, published by the American Bar Association and co-edited by Deborah Meshulam and Michael Fluhr, including chapters by Meshulam and Fluhr as well as by Margo H.K. Tank.

The MBA Compliance Essentials Remote Online Notarization State Surveys, developed by DLA Piper, provides a comprehensive look at RON requirements in each state that has enacted RON legislation. These fully editable surveys are organized by category of requirements, including registration, technology, seal and signature, certificates of RON acts, journal, authentication, session, recording and additional requirements. Companies can purchase the full package which includes surveys for all states that have enacted RON legislation along with a matrix summarizing state requirements, or companies can purchase information about individual states as needed.

Read

Transferring digital assets under UCC Article 8

In case you missed it

Read the latest issue of our bulletin Blockchain and Digital Assets News and Trends

Read the latest issue of our bulletin Consumer Finance Regulatory News and Trends

Contacts

Learn more about our eSignatures and ePayments practice by contacting:

The editors send their thanks and appreciation to Marc Aronson and Raymond Janicko for their contributions to this and prior issues.