18 September 2024 • 1 minute read

Global Tax Summit 2024

18 – 20 September, Málaga, SpainWe are delighted that you can join us for our exclusive annual Global Tax Summit, which will take place from 18 – 20 September in Málaga, Spain.

The Summit is set to be two days of stimulating technical sessions as well as social and networking activities. You will have the chance to catch up on the latest global tax developments and network with your peers and members of our global Tax team in a beautiful and relaxed setting.

Keynote Speakers

Agenda

16:00

Registration opens

During registration you will be issued with your conference name badge and itinerary which we recommend you have with you during core conference sessions.

19:00

Dinner

Technical sessions

8:45 – 10:00

Tax in time of transition – are international taxation / tax treaties in a “crisis”?

The developments of international tax policy of recent years show that the international tax order is strongly impacted by the transitional era we live in, adapting to changing directions when it comes to globalization and worldwide economy. Companies need to keep pace with a tax and economic environment in transition, which requires understanding the tax policy trends and anticipating future developments that could impact their operations. Following the two keynote speeches, our introductory session to the tax technical program will offer – in the format of a roundtable discussion - an analysis of the impact of the tax policy developments in the European Union and beyond on the traditional international tax framework. During the panel discussion the keynote speakers will be joined by Mr. Giuseppe Zingarro, Head of Group Tax Affairs at UniCredit, who will share his insights concerning the complexity and challenges of the ever-evolving international tax landscape from the perspective of corporate businesses.

Speakers

External

Fabrizia Lapecorella, OECD

Kees van Raad, International Tax Center Leiden

Giuseppe Zingaro, UniCredit

Internal

Sorina Van Kommer

10:00 – 11:00

How to find certainty amid tax policy transformation – outlook for direct and indirect tax controversy challenges / trends in Europe and beyond

An effective dispute resolution strategy is essential for multinational businesses – in terms of managing current controversies and the risk of future ones. During our session focusing on Tax Controversy, our panellists will share their thoughts on where controversies are arising, best practice for managing controversies, and the steps that can be taken to avoid the unnecessary escalation of disputes in the future, including the use of APAs and defence files.

Our DLA Piper speakers will be joined by Mr. Wade Owen, Vice President, Global Head of Transfer Pricing at Visa, who will share his experience on controversy management from different angles. During this session, we will also share the results of our ongoing survey of how our clients are managing tax controversies, allowing for peer to peer comparisons and providing other useful market data.

Speakers

External

Wade Owen, Visa

Internal

Jason Collins, Steve Dixon, Randall Fox, Antonio Tomassini, Stuart Walsh

11:00 – 11:30

Break

11:30 – 13:00

Essential in-country tax updates – hot topics in the key jurisdictions of the EU, UK, Singapore and Middle East

This round table session will bring the latest and most important legislative and case law developments around the globe to help you stay on top of changes in today's shifting legislative and regulatory environment. The panellists will touch base on several direct corporate income tax topics, with special focus on global mobility, anti-hybrid rules and tax incentives.

Speakers

Raphaël Béra, Maura Dineen, Ton van Doremalen, Michael Graham, Jian-Cheng Ku, Christian Montinari, Luis Muñoz, Carlos Rodríguez, Konrad Rohde, Barbara Voskamp

13:00 – 14:00

Lunch

14:30 – 17:00

Activities - as selected in your registration form and displayed on your personalised lanyard.

- Picasso Museum tour

Your guide will collect you from the hotel and walk you to the Picasso Museum. Along the way you will find out a little bit of the city’s history and some interesting anecdotes. Once in the museum, an inhouse Picasso expert will tell you a bit of this modern art genius’ life and of course his very important work. After an hour in the museum, you will get back onto the streets of the old town and enjoy some of the area’s most iconic sites. - Bike tour

A ten minutes’ walk from the hotel will take you to Malaga’s marina where your bike tour will start. Riding along the sea front, you will enjoy some of the city’s interesting points until you get to the Guadalhorse Natural Reserve Park. There the guides will show you the different observation spots of this important biosphere area. - Alcazaba and Roman Theater walking tour

Just a few minutes walking from the hotel, lie two of Málaga’s most important monuments. The incredible history behind both, together with some striking views of the city will enchant any visitors. Accompanied by your guide a all times, you will also learn interesting facts and see some important sites along the way.

17:00 – 17:30

Return to hotel

19:00 – 20:00

Pre-dinner drinks at El Merendero De Antonio Martin

The restaurant is a 7 minute walk from the hotel. If you wish to walk over as part of a group, please meet in the hotel reception at 18:45, otherwise feel free to make your own way there at your convenience.

20:00

Dinner at El Merendero De Antonio Martin

9:00 – 13:00

Breakout sessions - as selected in your preferences and displayed on your personalised lanyard.

Direct tax technical sessions for multinational companies

- Outlook for the current transfer pricing landscape

This session will provide an overview of the global transfer pricing environment, focusing on recent key policy developments, landmark international court decisions, and the latest trends in transfer pricing enforcement. Our international panel will analyse emerging themes that could potentially give rise to future disputes, while also exploring proactive strategies for both preventing and resolving these conflicts.

Key topics on the agenda include the latest updates on Pillar One - Amount B, and critical insights on intragroup financing practices. The panel will also discuss current trends in IP assets and the application of the profit split method. Additionally, the session will cover effective approaches for managing tax audits and practical challenges and opportunities associated with APAs and MAPs.

Speakers

External

Jenny Lau, Anglo American

Internal

Ulf Andresen, Juan Pablo Osman Moreno, Stephanie Pearson, Lucia Sahin

- The road towards sustainability and the ESG Agenda for Tax

Interest in environmental, social and governance (ESG) issues has grown exponentially over the past year. As stakeholders are focusing on more ESG drivers and climate change in investment decision-making, it is important that businesses understand the tax implications of ESG-related decisions. Reviewing existing tax policies and governance frameworks aiming at more tax transparency as well as the implications of green taxation for businesses will be among others the discussion points of this panel. Our DLA Piper speakers will be joined by Ms. Nicoletta Savini, Group Head of Tax at TIM Group and member of the EU Commission's board for good corporate tax governance, who will speak about the Commission's tax transparency initiatives and how the evolution of the tax transparency landscape is impacting corporate businesses.

Speakers

External

Nicoletta Savini, TIM and member of the board for good tax governance at the EU Commission

Internal

Ingvar Gjedrem, Giovanni Iaselli, Federico Pacelli

- Selected aspects of Pillar 2 – what do we see in practice?

In this session our Pillar 2 specialists will explore the latest on the OECD / G20 BEPS 2.0 developments on Pillar 2. They will not only provide an update on global policy developments and what countries in the EU and beyond consider but will also touch base on technical questions such as, can the UTPR withstand scrutiny, transitional safe harbor rules and the impact of QDMTT, interest deductibility for Pillar 2 purposes and what is the impact of Pillar 2 on M&A transactions. They will also share insights gained with the DLA Piper Pillar 2 Tool while assisting clients with their preparation to comply with Pillar 2 compliance requirements.

Speakers

Marica De Rosa, Nicolas Engelmann, Pie Geelen, Cesar Salagaray

Indirect tax technical sessions for multinational companies

In this session, we will explore the latest developments in VAT and other Indirect Taxes. Our discussion will cover recent challenges, best practices, and practical recommendations. The session will be divided into two parts: the first half will focus on services, while the second half will delve into goods-related topics.

We will begin by examining VAT issues related to holding companies, with a particular focus on VAT recovery on deal costs. This will be followed by a discussion on challenges concerning fixed establishments and deemed supplies.

To wrap up, we will provide an overview of supply chain issues, including VAT, Customs, and Environmental Taxation considerations.

Speakers

Daan Arends, Miguel Baz, Aloïs Charpenet, Björn Enders, Giovanni Iaselli, Lucia Sahin, Stuart Walsh, Richard Woolich

Tax technical sessions for asset management and funds

- Taxation of carried interest

This round table session will bring the latest and most important legislative updates concerning the taxation of carried interest in the United Kingdom and selected major jurisdictions in the European Union.

Speakers

Raphaël Béra, Jean Paul Dresen, Michael Graham, Antonio Longo, Marie-Theres Rämer

- International developments for funds

This session will address tax trends and developments outside Europe, addressing a.o. the specificities of the foreign source income exemption regimes of Singapore and Hong Kong and other topics relevant for funds and family offices. In addition, the speakers will give an update on the exemptions that have been introduced for investment funds and fund managers in the United Arab Emirates and the Free Zone Tax Regime (0% CIT) that can even apply in the funds space.

Speakers

Ton van Doremalen, Frank Mugabi, Jacques Wantz, Barbara Voskamp, Tina Xia

- VAT relevancy for the funds space

This session will focus on the recent VAT issues affecting investment funds. We will explore the boundaries of VAT exemptions related to the management of alternative investment funds and analyse how VAT may impact their structuring. The discussion will provide insights into these complex areas, offering practical guidance on navigating VAT considerations for asset managers.

Speakers

Aloïs Charpenet, Raphaël Béra

- TP relevancy for the funds space

Members of our global Transfer Pricing team will demonstrate by means of practical examples which transfer pricing considerations need to be made in course of structuring typical asset management activities.

Speakers

Rachit Agarwal, Antoine Faure

- Pillar 2 for funds – what do we see in practice?

While in general it will be uncommon for investment funds to be in scope of Pillar 2, the consequences of unexpectedly falling in scope are significant. Even where, as will often be the case, there is no top-up tax to be paid, the reporting obligations may be onerous and fall on entities that are not set up to easily fulfil them. During this session our experts will highlight points of considerations to assess the impact of Pillar 2 on fund structures.

Speakers

Carlotta Benigni, Raphaël Béra, Fanny Combourieu, Luis Muñoz

13:00 – 14:00

Lunch

14:00

Summit closes

Travel

![]() Transportation information

Transportation information

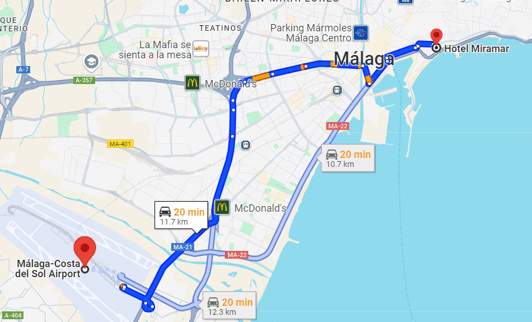

We recommend that you get a taxi (approx. 20 minutes) from Málaga airport to Gran Hotel Miramar.

There is also direct public transport (approx. 50 minutes) from Málaga airport to Gran Hotel Miramar.

The hotel's address is:

Gran Hotel Miramar

Paseo de Reding, 22-24,

29016 Málaga

Directions

Location map

Malaga Airport

Distance:

12.5 kilometres

20 minutes by taxi

Venue

Gran Hotel Miramar

Paseo de Reding, 22-24, 29016 Málaga

The Summit will be held at the Gran Hotel Miramar, which is located in the centre of Malaga, in the area of Caleta, between Paseo de Reding and a wonderful view of the city that will make your stay a unique experience.

Reservations for the conference must be made through the conference registration process. Please do not make reservations directly with the venue or through a third-party booking site.

Check-in: 15:00

Check-out: 12:00

Further information

Registration

Your conference invitation includes:

- Accommodation on 18 and 19 September

- All meals and drinks during your stay

- Full programme of conference sessions

- Social activities on 19 September

Please note that invited guests will be responsible for all other related expenses, including rail/air/car transportation; hotel transfers; charges for accommodation outside of the Summit dates; and any social activities outside of those planned.

Dress code

There is no dress code for the conference. Most delegates will be in smart / business casual attire.

Emergency contact details

Amanda Barker, Senior Marketing & Business Development Manager: +44 7971 142116 or amanda.barker@dlapiper.com

Stacey Warkup, Marketing & Business Development Manager: +44 7385 461822 or stacey.warkup@dlapiper.com