10 February 2025 • 11 minute read

White House Executive Orders impacting tax and trade – developments of the week of February 3, 2025

Last week, the White House issued two Executive Order (EO) updates (linked below for full text) delaying the imposition of 25-percent tariffs on both Mexico and Canada until March 4, 2025, stating in both EO updates:

“In recognition of the steps taken by the Government of [Canada/Mexico], and in order to assess whether the threat described in section 1 of this order has abated, the additional 25 percent ad valorem rates of duty, and 10 percent ad valorem rates of duty as to energy products, shall be paused and will not take effect until March 4, 2025, at 12:01 a.m. eastern time.”

Notable EO updates from the week of February 3, 2025

Last week in taxes

DLA Piper’s President Trump Executive Orders hub sets out Executive Actions of the new Administration for this week, as well as our coverage of those actions. In this alert, we also link to tax- and trade-specific EOs as well as potential legislation.

Following a busy few weeks of midnight regulations issuance and EOs implementing regulatory freezes and tariffs, we are beginning to observe initial reactions from both Congress and the corporate community.

Primary focus on Pillar Two

Republicans in Congress have stood firmly in opposition to any further engagement with the Organization for Economic Cooperation and Development (OECD), particularly related to Pillar Two of the Global Anti-Base Erosion Model Rules, which introduced a minimum tax rate on income for multinational enterprises.

Republicans in Congress have staunchly disapproved the Biden Administration’s affirmative approach to the OECD’s Pillar Two efforts in particular, which afforded a pathway to the OECD’s Undertaxed Profits Rule (UTPR) and the global 15-percent minimum tax. They have argued that both measures are overly punitive and have a disproportionate impact on US companies.

President Donald Trump’s increasingly strong statements that the US will explore protective measures in the face of US businesses being taxed “disproportionately” relative to its foreign counterparts, in addition to the recent EOs on tariffs directed at Mexico, Canada, and China, further instigated congressional action last week.

Republicans of the US House of Representatives’ Committee on Ways and Means sent a letter to President Trump praising his position on Pillar Two and his manner of engagement with the OECD, further highlighting their desire to move recently introduced legislation (“H.R.591 - To provide an enforcement of remedies against the extraterritorial taxes and discriminatory taxes of foreign countries.”) that would build on President Trump’s recent statements to enforce “reciprocal taxes.”

Further to this point, National Economic Council Director Kevin Hassett commented on “reciprocity” in the US’s trading relationships in support of the effort, highlighting that, “in 2023, US firms paid [USD]370 billion abroad in value-added and income taxes, while foreign multinational firms with operations in the US paid just [USD]57 billion.”

Republicans in Congress, however, may need to rethink ongoing assertions that the imposition of tariffs would “pay for tax reform.” Setting aside that tariffs imposed at the executive level cannot be factored into congressional scoring purposes, the proposed extension of Tax Cuts and Jobs Act (TCJA) tax cuts has been estimated to cost USD4.6 trillion, where preliminary estimates as to what the US would raise in revenue over a ten-year budget window for tariffs imposed on Mexico, Canada, and China would generate between USD1.1 trillion and USD1.3 trillion.

To further complicate the situation surrounding Pillar Two, the EU has asserted that its bloc will continue to enforce the 15-percent minimum tax regardless of the US’s recent actions and statements. However, caution was also issued this week by a member of the European Parliament. Fernando Navarrete Rojas of the People’s Party argued in a meeting that, if the EU implements the minimum tax in isolation, and without US participation, it would ultimately hamper investment into EU jurisdictions.

Both congressional tax writers and the executive branch have urged United Nations (UN) countries that have engaged in the OECD-led tax negotiations to question whether they should still be engaged with the OECD or withdraw altogether, as the US has. This was further emphasized following the US’s recent decision to withdraw from the UN’s development of a global tax convention.

Considering the above, Republicans in Congress still seem poised to retain the global intangible low-taxed income (GILTI), base erosion and anti-abuse tax (BEAT), and foreign-derived intangible income (FDII) regimes, and are assessing options for potentially adjusting the rates and working with stakeholders on improvements.

Reconciliation: When could we see a tax bill?

In order to dive deeper, Republicans in the House and US Senate will need to kick off the reconciliation process by passing a unified budget resolution, which House Republicans have struggled with as a result of Freedom Caucus Republicans in the House’s firm stance on budget-cut demands. In addition, House Republicans are attempting to fold everything, including taxes, immigration, and energy, into a single reconciliation bill.

Alternatively, the Senate Chamber introduced its own budget resolution last week that included border/immigration and energy measures, while punting taxes to a second reconciliation measure for later this year.

As of the morning of Monday, February 10, 2025, the House still appears to be working to get the necessary number of Republican House members on board for a budget reconciliation bill. The ongoing complication is a direct byproduct of House Speaker Mike Johnson’s attempt to fold border/immigration, energy, and tax reform into one reconciliation package.

At this juncture, the Senate Chamber has said the one-bill approach is not feasible, arguing that tax reform is too complex an undertaking to be completed both quickly and successfully. The Senate stated that border/immigration reforms need more time for negotiation and cannot wait until the end of the year, hence its push for a two-bill approach.

What about the impact of tariffs on decisions regarding tax reform?

We are in uncharted territory with President Trump’s recent approach to tariff impositions, notwithstanding the one-month delay in applications to Mexico and Canada.

It is unclear how broadly and how long President Trump may choose to impose tariffs on Mexico, Canada, and China; whether he will choose to expand imposition of tariffs to other jurisdictions; or how any future passage of the suggested “reciprocal” taxes contemplated in recent legislation might impact Congress’s approach to tax reform this year.

It is likely that, with the aforementioned activity that stands to directly impact the policy and political environment of tax reform, there will be significant and increasing pressure on the Trump Administration and congressional tax writers to:

Dive deeper into tax cuts and fiscal relief for US families impacted by the anticipated exacerbation of inflationary prices that could result from tariffs and reciprocal taxes

Respond more expansively to companies contemplating the impacts of tariffs on their supply chains and subsequent upward pressure on prices to US consumers by seeking to give deeper incentives on US manufacturing and “Made-In-America” incentives, and

Consider whether Congress feels inclined to more aggressively target specific incentives for certain industries and activities within the US that could offer fiscal relief from the impact on companies of tariffs. If we start to see disproportionate impacts of some of these peripheral issues on certain industries and activities, we could see more granular focus of tax and economic ideas to impart relief.

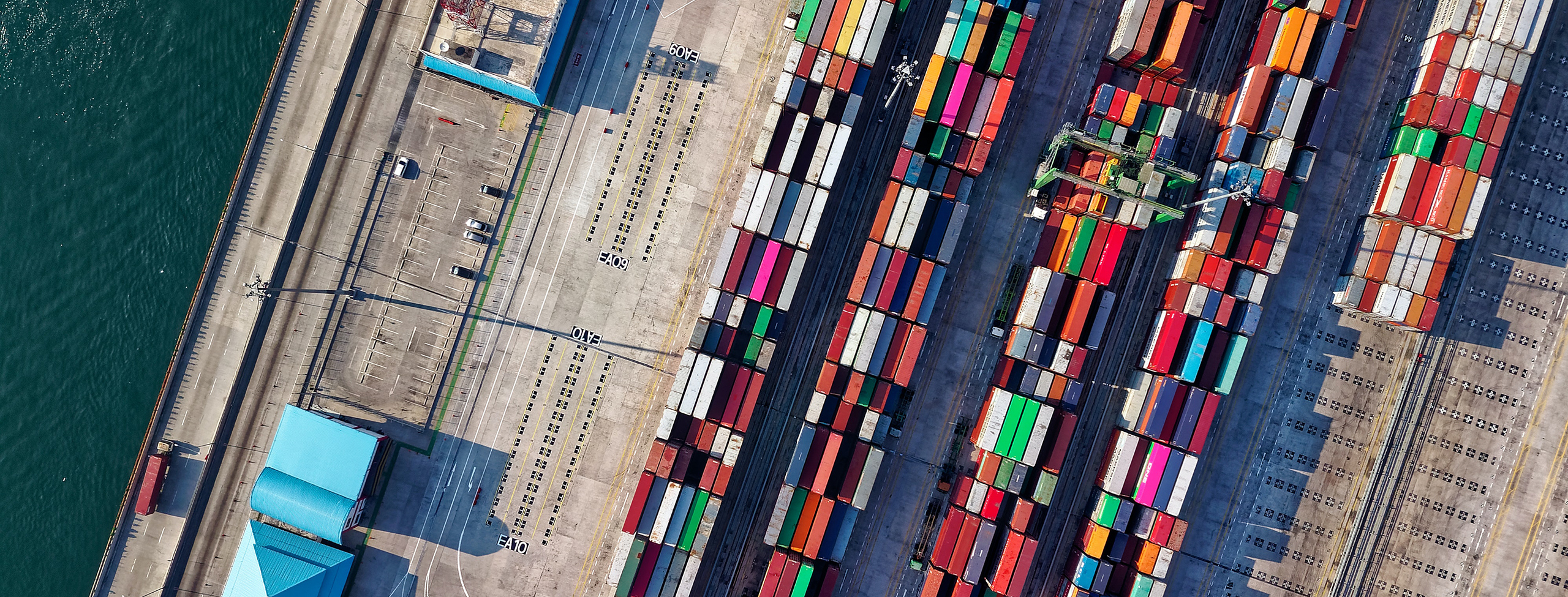

Trade, tariffs, and President Trump

On Saturday, February 1, 2025, President Trump signed three EOs instituting new tariffs on all goods imported from Canada, Mexico, and China, effective Tuesday, February 4, 2025. On Monday, February 3, 2025, the Trump Administration announced it would delay the imposition of tariffs on Mexico and Canada until Tuesday, March 4, 2025 in response to commitments from the two countries to address the border crisis, including sending 10,000 soldiers to each country’s border with the US. The ten-percent duty on all imports from China went into effect on Tuesday, February 4.

China responded by imposing retaliatory tariffs on US energy products, agricultural machinery, and large cars and trucks; announcing heightened export controls on Chinese critical minerals; and targeting US companies including Google, Illumina Inc., and PVH Corp. with regulatory actions. The delayed tariffs on Canada and Mexico would impose an additional 25-percent duty on all imports from Mexico and an additional 25-percent duty on all imports from Canada – except energy and energy resources from Canada, which will be subject to a lower 10-percent additional duty.

The delay in imposing the new tariffs on Canada and Mexico gives companies an additional month to assess their exposure and explore ways to mitigate duty liability. While there has been talk of possible opportunities for companies to request exclusions for critical imports, the Trump Administration has yet to provide any detail on whether and when such an exclusion process will be available.

The EOs also state that the Section 321 de minimis exemption, which currently allows most imports valued at under USD800 to enter duty-free, will not be available for products from Mexico, Canada, and China that are subject to these new tariffs. On Friday, February 7, 2025, the Trump Administration announced that it would pause the repeal of duty-free treatment for these low-cost packages from China to allow the government to make the order workable, after the rapid rollout of the new policy caused disruptions at entry points. Additionally, the EOs state that no drawback will be allowed on these duties.

Over the weekend, President Trump said that, on Monday, February 10, he would announce 25-percent tariffs on all steel and aluminum entering the US, and that, on Tuesday or Wednesday, he would announce “reciprocal tariffs” on countries that levy duties on imports from the US.

This next round of tariffs is expected to apply to countries beyond Canada and Mexico and may take the form of across-the-board tariffs on all products from a given country or targeted tariffs on certain sectors. President Trump has continued to highlight the trade imbalance with the EU, suggesting it will be one of the targets of next week’s tariff actions. President Trump has also identified pharmaceuticals, oil and gas, and semiconductors as sectors that may face new tariffs in the coming weeks and months.

Our National Security and Global Trade team is closely following these developments and remains well positioned to advise clients on how to plan for and respond to the evolving tariff landscape. For additional detail on this week’s tariff actions, please see our client alert: "New Trump Administration tariffs on Canada, Mexico, and China."

Key tax/trade bills introduced the week of February 3, 2025

S.358 - A bill to amend the Internal Revenue Code of 1986 to increase the threshold amounts for inclusion of Social Security benefits in income.

S.369 - A bill to amend the Internal Revenue Code of 1986 to deny certain green energy tax benefits to companies associated with foreign adversaries.

H.R.1040 - To amend the Internal Revenue Code of 1986 to repeal the inclusion in gross income of Social Security benefits.

H.R.1062 - To amend the Internal Revenue Code of 1986 to repeal the scheduled reduction in the deduction for foreign-derived intangible income.

H.R.1103 - To amend the Internal Revenue Code of 1986 to permanently extend the new markets tax credit, and for other purposes.

H.Con.Res.8 - Expressing the sense of Congress that the US should resume normal diplomatic relations with Taiwan, negotiate a bilateral free trade agreement with Taiwan, and support Taiwan’s membership in international organizations.

S.409 - A bill to amend the Internal Revenue Code of 1986 to provide for current year inclusion of net CFC tested income, and for other purposes.

S.425 - A bill to amend the Internal Revenue Code of 1986 to modify the carbon oxide sequestration credit to ensure parity for different uses and utilizations of qualified carbon oxide.

S.429 - A bill to enhance the economic and national security of the US by securing a reliable supply of critical minerals and rare earth elements through trade agreements and strategic partnerships.

S.448 - A bill to amend the Internal Revenue Code of 1986 to expand the advanced manufacturing production credit to include distribution transformers.

S.479 - A bill to amend the Internal Revenue Code of 1986 to permanently extend the new markets tax credit, and for other purposes.

Learn more

We look forward to bringing you timely updates in the near future. To learn more about these rapidly evolving developments, please contact Evan Migdail or Melissa Gierach, or check out our resource page with related materials focused on the tax implications of recent tax and trade proposals.