25 January 2024 • 11 minute read

The importance of transfer pricing analysis in leveraged blockers used by foreign investors

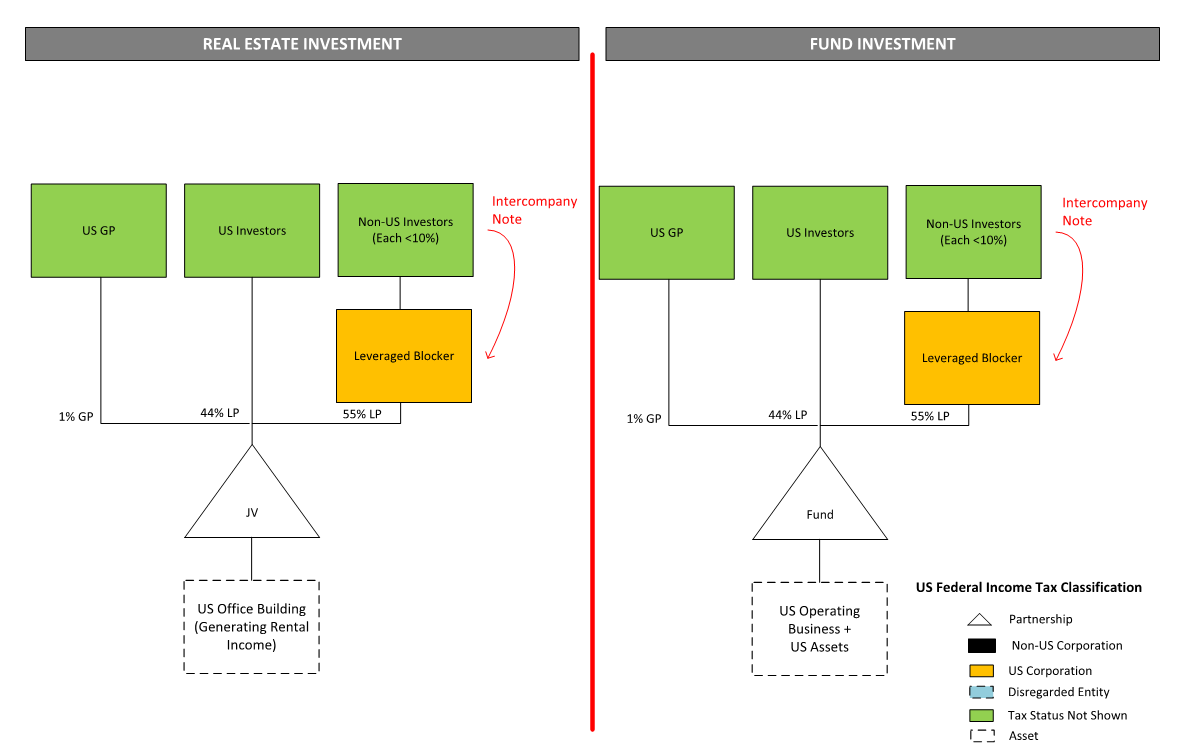

On December 19, 2023, the IRS released IRS Chief Counsel Memo AM 2023-008 (IRS Transfer Pricing Memo), which highlights the importance of having appropriate transfer pricing analyses to support intercompany financing arrangements. In the real estate and investment funds industry, foreign investors frequently use leveraged blockers to passively invest in US investments that are structured as US partnerships.

This client alert reviews the background for the use of leveraged blockers, the summary of the IRS Transfer Pricing Memo, and our practical takeaways.

Background

For tax and non-tax reasons, foreign investors frequently prefer to invest in a US real estate or investment fund through a leveraged blocker entity. A leveraged blocker is typically a US corporation that is capitalized partially by shareholder equity and partially with shareholder debt. From a tax perspective, the leveraged blocker is designed with three purposes: (a) to reduce a non-US investor’s US federal income tax reporting and compliance burden; (b) to generate an interest deduction to reduce the blocker’s entity level tax; and (c) to partially convert highly taxed US trade or business income into tax-free return of principal or interest income or low-tax interest income. See below for a typical leveraged blocker structure to guide our discussion:

Partnership versus corporation

Entities that are disregarded or treated as partnerships for US federal income tax purposes do not pay such taxes at the entity level. Instead, they “pass through” their income to their owners. In contrast, entities that are treated as corporations for US federal income tax purposes are taxed at the entity level. This arrangement will “block” their foreign owners from incurring direct US tax filing obligations, which would otherwise subject them to the full investigatory authority of the IRS. These non-US owners typically only include such items in income upon a distribution from the corporation and are generally not required to file income tax returns with respect to these earnings.

Leverage

Although foreign investors are generally subject to 30 percent withholding on US-source interest income, the leverage used to capitalize a blocker is often structured in a way that allows a non-US investor to qualify for a reduction or exemption from US withholding tax. Non-US investors may qualify for the portfolio interest exemption, a sovereign wealth fund may be exempt under Section 892, or a non-US investor may qualify for a reduced or zero rate of withholding under an applicable Income Tax Treaty. In addition to navigating the specific legal requirements of these reductions or exemptions, a critical step is ensuring that the shareholder loan is respected as debt for US federal income tax purposes and bears an arm’s-length interest rate. Taxpayers are advised to conduct a transfer pricing study to help support these structures.

Overview of IRS memo

On December 19, 2023, the IRS published a memorandum on one element of intercompany loans, confirming its position that group membership may be considered in determining an arm’s-length interest rate for intragroup loans. Under certain circumstances, the credit worthiness of a related party Investor may impact the credit rating of a borrowing subsidiary. The IRS Transfer Pricing Memo is the culmination of a multiyear process by both the Organization of Economic Cooperation and Development (OECD) and the US Treasury to provide tax guidance on a series of financial transaction issues between related enterprises covering treasury activities such as hedging, cash pooling, intercompany loans, financial guarantees, and captive insurance arrangements.

Specifically, the IRS Transfer Pricing Memo states that “the arm’s length rate of interest on an intragroup loan to a controlled borrower is generally the rate at which that borrower could realistically obtain alternative financing from an unrelated party.” Since the credit worthiness of a company is generally determined by its credit rating, rating agencies typically consider (i) the relationship of a borrower’s business and assets to that of the overall group, and (ii) absent any formal guarantee, the likelihood that other group members would provide financial support in the event of financial distress.

The IRS recommends that any credit uplift from such ‘implicit support’ be considered when analyzing the creditworthiness of a controlled borrower and arm’s-length interest rate charged on intragroup lending. Moreover, this implicit support does not require compensation, so no loan guarantee fee is required to offset the lower interest rate.

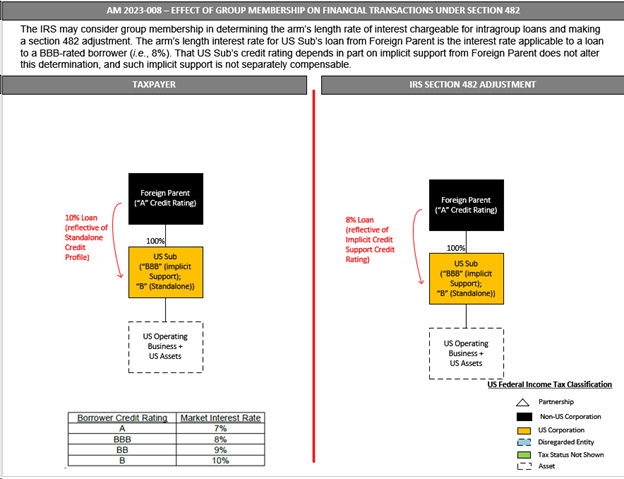

The figure below provides a brief summary of the effect of ‘implicit support’ provided by group membership on the pricing of intercompany financial transactions.

Figure 2: Effect of group membership on financial transactions

The IRS Transfer Pricing Memo suggests that the credit rating of the overall group could be a relevant starting point if the transaction is structured such that an unrelated lender would consider the group nature when considering a loan to a controlled subsidiary. As most investor groups have higher credit ratings than highly leveraged subsidiaries, this would imply a lower interest rate and a lower level of interest deductibility. Conversely, if the transaction is structured such that no reasonable unrelated lender would expect a group member to provide emergency funding at times of stress, the group nature would not impact the credit rating, and a (presumably) higher rate of interest can be supported.

Application of IRS guidance in the context of investment funds and real estate investments

In principle, this suggests that the IRS could take the credit worthiness of a foreign investor into account along with other entities in a real estate or investment fund structure to determine the credit rating of the leveraged blocker. In the case of leveraged blockers shared by sovereign wealth funds or qualified foreign pension funds with trillions of assets, this interpretation could materially decrease the rate of borrowing of the intercompany loan extended by the foreign shareholders to the blocker. However, if the transfer pricing analysis employs a “nonrecourse” analysis based on expected cash flows rather than implicit credit rating, we believe that this risk may be mitigated. We recommend a loan agreement and transfer pricing analysis that substantiates the following:

- The bona fide nature of the debt with consistent expected cash flows, sufficient coverage ratios, and appropriate covenants

- A lack of expectations that the blocker borrower will receive support from foreign investor equity holders

- Evidence that the debt capacity of the blocker is based on the nature of the investments of the blocker, and

- An arm’s-length interest rate consistent with the nature of the investments of the blocker.

In this transactional context, credit rating agencies recommend using a recovery-based approach. This involves an assessment of the expected recovery to a given transaction in an event-of-default. This entails an analysis of the revenue and expense drivers affecting the asset to forecast property cash flow. For example, in a structure where a fund is investing in real estate, the credit risk is determined through an examination of the underlying property and determining the debt-service-coverage and loan-to-value ratios, rather than analyzing the balance sheet of the foreign investors of the blocker.

Use of quotes to price intercompany loans

A transfer pricing analysis requires the use of actual, concluded market transactions to price an intercompany transaction. An informational inquiry with a bank is generally not accepted as appropriate support for arm’s-length pricing under either the US transfer pricing regulations or the OECD guidelines. This is also consistent with audit experience in many jurisdictions, including the US, where tax authorities have regularly rejected the use of quotes as not having sufficient evidentiary value, preferring comparable market transactions instead.

Transfer pricing penalties

Code sections 6662(e) and 6662(h) impose two types of penalties:

|

|

Transactional penalty |

Net adjustment penalty |

|

Substantial valuation (20-percent penalty) |

Price charged is less than 50 percent, or greater than 200 percent of price determined by IRS |

“Net section 482 adjustment” exceeds the lesser of $5 million or 10 percent of gross receipts |

|

Gross valuation (40-percent penalty) |

Price charged is less than 25 percent, or greater than 400 percent of price determined by IRS |

“Net section 482 adjustment” exceeds the lesser of $20 million or 20 percent of gross receipts |

The transactional penalty can be avoided either by (i) demonstrating reasonable cause and good faith, under the general rules of Regulations Section 1.6664-4, or (ii) by satisfying the contemporaneous documentation rules.

The net adjustment penalty can be avoided only by satisfying the contemporaneous documentation rules. Therefore, in order to avoid penalties, it is prudent to prepare a transfer pricing analysis which clearly documents (i) the contractual terms and conditions of an intercompany loan, (ii) the framework used to determine a credit rating estimate, and (iii) comparable uncontrolled transactions used to determine the arm’s-length interest rate.

Key takeaways

In light of the publication of the IRS Transfer Pricing Memo together with increased audit activity in this area, we encourage taxpayers to document intercompany loans and contemporaneously conduct transfer pricing studies in a manner that takes into account the recommendations provided in this alert to support their leveraged blocker structures.

A leveraged blocker structure that is properly structured, including with the support of an appropriate transfer pricing study, would likely reduce the likelihood of an adjustment on audit and, in particular, mitigate costly transfer pricing penalties that can be up to 40 percent of any sustained adjustment.

To learn more, please contact any of the authors listed above.