31 May 2023 • 21 minute read

NAV REIT valuations: The role of third-party valuation experts

Acknowledgements: Special thanks to Kevin T. Gannon, Chief Executive Officer of Robert A. Stanger & Co., Inc. (Stanger) an investment banking firm focused on alternatives; David J. Inauen, Executive Managing Director and Head of Research at Stanger; and Christopher M. Johnston, EY Americas REIT Leader, Ernst & Young LLP, for their contributions to certain portions of this article.

The only rules that govern how publicly offered NAV REITs1 must calculate the net asset value (NAV) of their shares are Financial Industry Regulatory Authority (FINRA) rules applicable to broker-dealers participating in the offerings.2 Under FINRA Rules 2310 and 2231,3 for a broker to participate in an NAV REIT public offering and include the NAV per share on customer account statements, the NAV per share must be:

The only rules that govern how publicly offered NAV REITs1 must calculate the net asset value (NAV) of their shares are Financial Industry Regulatory Authority (FINRA) rules applicable to broker-dealers participating in the offerings.2 Under FINRA Rules 2310 and 2231,3 for a broker to participate in an NAV REIT public offering and include the NAV per share on customer account statements, the NAV per share must be:

(a) based on valuations of the assets and liabilities of the company performed at least annually, by, or with the material assistance or confirmation of, a third-party valuation expert or service and

(b) derived from a methodology that conforms to standard industry practice.

Over seven years have passed since these FINRA rules went into effect, during which time the valuation practices of NAV REITs have evolved. In this article, we answer frequently asked questions about how publicly offered NAV REITs satisfy these FINRA rules. More specifically, we examine the role of third-party valuation experts in the NAV procedures of the top ten NAV REITs that primarily make equity real estate investments.4

We believe the information below is helpful for NAV REITs that are adopting valuation procedures or considering changes to existing valuation procedures. The market has not adopted a one-size-fits-all approach. NAV REITs may consider a variety of different approaches when involving independent valuation experts in their valuation process. Factors that could affect decisions include (a) the size and composition of the portfolio; (b) the internal resources of the NAV REIT or its external advisor (the Advisor); (c) cost and capabilities of the independent valuation expert(s); and (d) marketing and distribution related considerations.

On January 31, 2014, FINRA filed with the US Securities and Exchange Commission (the SEC) a proposed rule change to amend provisions in the National Association of Securities Dealers, Inc. (NASD) and FINRA rulebooks addressing per share estimated valuations for unlisted direct participation program (DPP) and non-traded real estate investment trust (non-traded REIT) securities.5 In particular, FINRA proposed revising NASD Rule 2340 (Customer Account Statements) to modify the requirements relating to the inclusion of a per share estimated value for unlisted DPP and non-traded REIT securities on a customer account statement and FINRA Rule 2310 (Direct Participation Programs) to modify the requirements applicable to broker-dealers’ participation in a public offering of DPP or non-traded REIT securities.6 The proposal was intended to protect the investing public by seeking to ensure that any per share estimated value for an unlisted DPP or REIT security included on a customer’s account statement would be developed in a manner reasonably designed to ensure that it is reliable. In developing the proposed rule change, FINRA consulted extensively with members and other industry participants.7 On July 11, 2014, FINRA filed a letter responding to comments and Amendment No. 1 to the proposed rule change.8 The SEC approved the proposed amendments on October 10, 20149 and they went into effect on April 11, 2016.10 Subsequently, as part of the process of completing a consolidated FINRA rulebook, NASD Rule 2340 was adopted as FINRA Rule 2231 (and is referred to as FINRA Rule 2231 for the remainder of this article).11

The prior rules required a broker-dealer to include on account statements an estimated value of a publicly offered non-traded REIT security from the annual report, an independent valuation service or any other source, unless the broker-dealer could demonstrate the estimated value was inaccurate. Under the new rules, FINRA Rule 2310 does not permit a broker-dealer to participate in a non-traded REIT public offering unless the REIT has agreed to disclose (a) a per share estimated value of the security, developed in a manner reasonably designed to ensure it is reliable, in the REIT’s periodic reports filed under the Exchange Act of 1934, as amended (the Exchange Act); (b) an explanation of the method by which the per share estimated value was developed; (c) the date of the valuation; and (d) in a periodic or current report filed under the Exchange Act within 150 days following the second anniversary of breaking escrow and in each annual report thereafter, a per share estimated value: (i) based on valuations of the assets and liabilities of the REIT performed at least annually, by, or with the material assistance or confirmation of, a third-party valuation expert or service; (ii) derived from a methodology that conforms to standard industry practice; and (iii) accompanied by a written opinion or report by the issuer, delivered at least annually, that explains the scope of the review, the methodology used to develop the valuation or valuations, and the basis for the value or values reported.

FINRA Rule 2231, which works in conjunction with Rule 2310, requires a broker-dealer to include in a customer account statement a per share estimated value of a non-traded REIT security that is developed in a manner reasonably designed to ensure that the per share estimated value is reliable. FINRA Rule 2231 provides two methodologies that will be deemed to have been developed in a manner reasonably designed to ensure that the per share estimated value is reliable: (a) the “net investment methodology” and (b) the “appraised value methodology.” The net investment methodology (which may be used only until 150 days following the second anniversary of breaking escrow) estimates a per share value by starting with the offering price and deducting estimated sales commissions, dealer manager fees and other organization and offering expenses. The net investment methodology does not value the underlying assets and liabilities and a non-traded REIT would not be considered an “NAV REIT” while using this approach to satisfy the FINRA rules. NAV REITs use the appraised value methodology. Under the appraised value approach, at any time, the broker-dealer may include a per share estimated value reflecting an appraised valuation disclosed in the REIT's most recent periodic or current report that is (i) based on valuations of the assets and liabilities of the REIT performed at least annually, by, or with the material assistance or confirmation of, a third-party valuation expert or service and (ii) derived from a methodology that conforms to standard industry practice.

What constitutes a valuation of assets and liabilities “by, or with the material assistance or confirmation of, a third-party valuation expert or service” and “derived from a methodology that conforms to standard industry practice”?

Prior to proposing the rule changes discussed above, FINRA solicited comments in two Regulatory Notices.12 FINRA received several comments on the use of a per share estimated value based upon an appraisal or valuation of the program’s assets and operations, some of which requested that FINRA, at a minimum, clarify whether it would create or require members to use a standardized valuation methodology. FINRA declined to require a standard approach, instead stating that “in view of the broad range of DPPs and REITs existing in the marketplace, the current proposal permits flexibility in choosing a methodology for developing an independent valuation.”13

FINRA did note that valuation definitions and methodologies for real estate investments generally use US Generally Accepted Accounting Principles (GAAP) set forth in Financial Accounting Standards Board Accounting Standards Codification Topic 820, Fair Value Measurements (ASC 820).14 In our survey, all ten NAV REITs stated that their valuation procedures adjust the value of assets and liabilities from historical cost to fair value generally in accordance with the principles set forth in ASC 820, as appropriate. ASC 820 defines the term “fair value” and provides conceptual guidance on how to determine fair value for financial reporting purposes. This guidance is primarily principles-based and generally does not provide specific rules or detailed “how-to” guidance. As such, the application of ASC 820 requires significant judgment applied using the core concepts of ASC 820’s principles-based framework for fair value measurements.15

That said, in our survey we found that, in practice, some assets (other than real property) and liabilities are not valued in accordance with GAAP or ASC 820 for purposes of the NAV calculations. These frequently include (a) liabilities for ongoing trail commissions, which are only recognized as a liability for the NAV calculations when currently due (ie, even though an estimate of the future trail commissions must be accrued at the time of sale of a share with a direct charge to equity, there is no liability estimate for future trail commissions for purposes of the NAV calculation) and (b) organization and offering expense liabilities that may be due to the Advisor over time and are amortized over that period for the NAV calculation. In addition, two of the NAV REITs surveyed do not fair value property-level mortgages and corporate-level credit facilities that are intended to be held to maturity, and one of the NAV REITs surveyed values all of its liabilities at cost (including debt obligations).

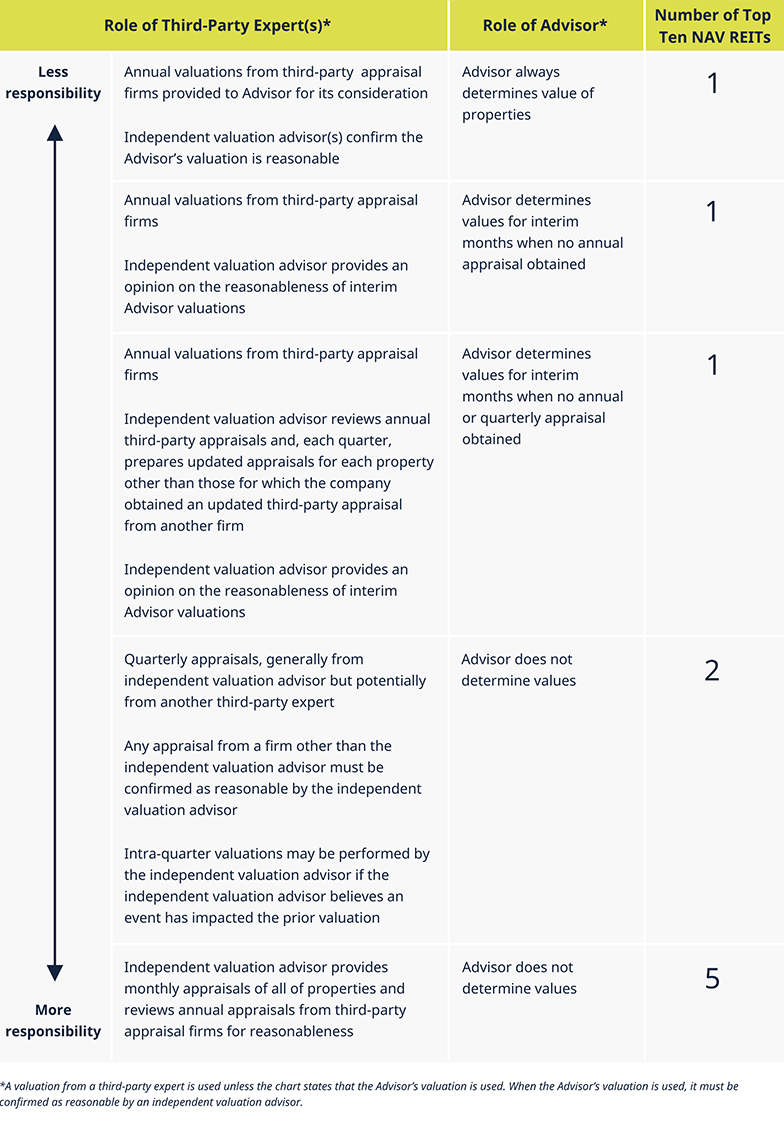

With regard to the involvement of third-party valuation experts, in our survey of the top ten NAV REITs we found a variety of approaches, as described below.

Which assets and liabilities are valued with the assistance of an independent valuation expert and what form of assistance is provided?

Real property

- Nine NAV REITs surveyed stated that they use the assistance of an independent valuation expert to value their consolidated/wholly owned properties and properties held through joint ventures. One NAV REIT simply states that it uses the assistance of an independent valuation expert to value its real estate properties and does not separately address properties held through joint ventures.

- One NAV REIT surveyed states that annual valuations from third-party appraisal firms will be one of several components considered by the Advisor in determining the monthly value of the real properties and that the Advisor’s valuations will be reviewed by a separate independent valuation advisor for reasonableness.

- One NAV REIT surveyed obtains rolling annual third-party valuations of its real properties, which are initially used without adjustment. The Advisor may adjust these values for interim months, in which case they are reviewed for reasonableness by an independent valuation firm.

- One NAV REIT surveyed uses an independent valuation advisor to review annual third-party appraisals and, each quarter, to prepare updated appraisals for each property other than those for which the company obtained an updated third-party appraisal from another firm. These are the valuations used in the calculation of the company’s NAV except for updated valuations from the Advisor for months that are not a quarter-end; the independent valuation firm provides an opinion on the reasonableness of these Advisor valuations.

- Two NAV REITs surveyed obtain quarterly appraisals of their properties, generally from their independent valuation advisors but potentially from other third-party experts. Any appraisal from a firm other than the independent valuation advisor must be confirmed as reasonable by the independent valuation advisor. Intra-quarter valuations may be performed by the independent valuation advisor if the independent valuation advisor believes an event has impacted the prior valuation.

- Five NAV REITs surveyed have engaged an independent valuation advisor to provide monthly appraisals of all of their properties and to review annual appraisals from third-party appraisers for reasonableness.

The chart below summarizes the approaches to property valuations.

Other assets

- One NAV REIT states that an independent valuation expert will assist in the valuation of real estate debt investments and private company investments without readily available market quotations, without providing clarity on what this form of assistance would be.

- One NAV REIT uses an independent third-party appraiser to value its operating company investments annually and such valuation is reviewed by another independent valuation firm for its reasonableness. For months in which a third-party appraiser does not perform a valuation, the Advisor will perform a monthly valuation which is reviewed by an independent valuation firm for its reasonableness.

- One NAV REIT says that its property management business will be valued by an independent valuation advisor.

- One NAV REIT states that a valuation committee of the board may choose the Advisor, the company’s independent valuation advisor, or another third-party pricing source as the pricing sources of real estate-related assets, but that generally those pricing sources are independent third parties and not the Advisor.

- One NAV REIT states that its board of directors may retain independent valuation firms to assist with the valuation of private real estate-related assets, without providing clarity on what this form of assistance would be.

- Three NAV REITs state that pricing sources of real estate-related assets and other assets are approved by the board of directors and generally third parties other than the Advisor, but that the Advisor may be used if the asset is not considered material to the company or there are no other pricing sources reasonably available. Two of these state that their independent valuation advisor provides monthly valuations of loan investments.

- One NAV REIT states that private real estate-related assets are normally valued by the Advisor but that the board of directors may retain additional independent valuation firms to assist with the valuations. This NAV REIT also states that debt investments are initially valued at cost and are then valued quarterly by the independent valuation advisor.

- One NAV REIT states that real estate-related debt investments are valued by independent third-party valuation providers.

- One NAV REIT states that debt investments will be valued by the independent valuation advisor and real estate-related securities and other securities that do not have reliable readily available market quotations will be valued by a third-party pricing service.

Overall, NAV REITs use a variety of approaches when involving third-party experts in the valuation of assets other than real property and leave themselves with quite a bit of flexibility. This is understandable, given that all of the NAV REITs surveyed invest primarily in real property (ie, the valuation of property is by far the most important component of their valuation procedures) and may have different strategies regarding the type, amount and size of other assets that they own. The types of “other assets” that may be valued with the assistance of a third-party expert are generally assets without reliable and readily available market quotations, described by NAV REITs as debt investments, securities investments, private company investments and operating company investments (eg, an internal property management business).

Liabilities

- One NAV REIT states that property-level mortgage and corporate debt will be valued by the Advisor and reviewed for reasonableness by an independent third party.

- One NAV REIT states that property-level mortgages are valued quarterly by the independent valuation advisor.

- One NAV REIT states that an independent third-party valuation provider prepares monthly valuations for property-level debt liabilities.

- One NAV REIT states that in determining the fair value of property-level mortgages and corporate-level debt the Advisor relies primarily on a third-party expert to provide the fair value calculations.

- Two NAV REITs state that property-level mortgages and corporate-level credit facilities that are not intended to be held to maturity are valued by the Advisor and reviewed by the independent valuation advisor. As a practical matter, this means that all (or nearly all) of their property-level mortgages and corporate-level credit facilities are valued at par.

- One NAV REIT states that all of its liabilities are valued at cost (including debt obligations), meaning there would be no role for a third-party valuation expert.

NAV calculation

- One NAV REIT states that the monthly NAV per share calculation for each class of shares will be reviewed by an independent valuation advisor by utilizing third-party appraised property values, the third-party valuations of certain other assets and liabilities and interim valuations and other information provided by the Advisor regarding balances of cash, tenant and other receivables, accounts payable and accrued expenses, distributions payable and other assets and liabilities.

- No other NAV REIT surveyed has the monthly NAV per share calculation reviewed by a third-party valuation expert.

What is the frequency of assistance by independent valuation experts?

Nine of the NAV REITs surveyed calculate the NAV of their shares monthly while one calculates it daily. However, as described above, the assistance of independent valuation experts as part of the NAV calculation process may be provided on a monthly, quarterly or annual basis, depending on the role of the independent expert in the valuation process for a particular asset or liability.

Are independent valuation experts involved in creation of the valuation guidelines?

Two NAV REITs state that an independent valuation advisor will review the valuation guidelines and methodologies related to investments in real property and certain real estate debt and other securities with the Advisor and board of directors at least annually. Three others state that at least once each calendar year, the board of directors reviews the appropriateness of the valuation procedures with input from an independent valuation advisor.

Are independent valuation experts involved in allocating changes in company NAV among different share classes?

All ten NAV REITs surveyed offer multiple classes of shares with different class-specific fee, expense and/or performance allocation accruals. The Advisor performs the monthly or daily NAV per share calculations for three of the NAV REITs, while seven have engaged third-party providers to perform the calculations. None of these third parties are considered valuation experts as they do not assist in the valuation of any of the company’s assets or liabilities. As discussed above, only one NAV REIT surveyed states that the monthly NAV per share calculation for each class of shares will be reviewed by an independent valuation firm (this is an NAV REIT for which the Advisor performs the monthly NAV per share calculations).

Are independent valuation experts named in the public offering documents of NAV REITs?

If a report, valuation or opinion of an expert is included or summarized in a registration statement and attributed to a third party it becomes “expertised” disclosure for purposes of Section 11(a) of the Securities Act of 1933, as amended (the Securities Act), with resultant Section 11 liability for the expert and a reduction in the due diligence defense burden of proof for other Section 11 defendants with respect to such disclosure.16 Under Section 7(a) and Rule 436 under the Securities Act, the expert must consent to be named in connection with such disclosure.17 A company conducting a public offering is not required to make reference to a third-party expert simply because it used or relied on the third-party expert’s report or valuation or opinion in connection with the preparation of a Securities Act registration statement.18 But a company may wish to do so for the Section 11 liability reasons described above as well as to bolster confidence by broker-dealers and investors in its valuation process.

When a valuation figure is not expertized, the SEC staff will require disclosure regarding the manner in which the figure was determined to avoid any characterization that the figure is in fact calculated by third-party experts.19

We note that in the final proposed FINRA Rules 2310 and 2231, FINRA amended its original proposal to eliminate a requirement to name the third-party experts,20 and FINRA and the SEC declined a request from a commenter on the final proposed rules to restore that requirement.21

In our survey, all but one of the ten NAV REITs name one independent valuation advisor as providing assistance with the valuation of their real property investments. In some cases, the NAV REITs state that the named independent valuation advisor assists with valuing other assets and/or debt liabilities. A number of the NAV REITs surveyed state that they may engage additional third-party valuation experts from time to time, without naming them. One NAV REIT does not specifically name any independent valuation expert and specifically states that it may use multiple valuation experts to assist with the valuation of its real properties and certain real estate debt and other securities.

To learn more about NAV REIT valuations, please contact the author or your usual DLA Piper attorney.

2 While these rules do not apply to privately offered NAV REIT securities sold by broker-dealers, privately offered NAV REITs often adopt valuation practices similar to those of publicly offered NAV REITs for consistency with market practice and broker-dealer expectations.

3 These rules have special provisions for 40 Act REITs, which are beyond the scope of this article.

4 Based on capital raised over the trailing 12 months ended March 31, 2023, according to data provided by Stanger.

5 Under the applicable definitions for these rules, NAV REITs are non-traded REITs and not DPPs, although FINRA frequently interprets DPPs to include NAV REITs.

6 See SEC Release No. 34-71545 (Feb. 12, 2014).

7 Id. at 8.Prior to the adoption of these rules, the general industry practice was to use the offering price of non-traded REIT securities as the per share estimated value during the offering period, which could continue for many years. The offering price would frequently remain constant on customer account statements during this period even though various costs and fees may have reduced investors’ principal and underlying assets may have decreased in value. See FINRA Regulatory Notice 15-02 (Jan. 2015).

8 See SEC Release No. 34-72626 (July 16, 2014).

9 See SEC Release No. 34-73339 (Oct. 10, 2014).

10 See FINRA Regulatory Notice 15-02 (Jan. 2015).

11 See SEC Release No. 34-85589 (April 10, 2019).

12 See FINRA Regulatory Notice 11-44 (Sept. 2011) and Regulatory Notice 12-14 (Mar. 2012).

13 See SEC Release No. 34-71545 at 23.

14 Id. at 6.

15 See Ernst & Young LLP, “Financial reporting developments – A comprehensive guide. Fair value measurement,” (rev’d Sept. 2022), at 3. The various methodologies for valuing assets and liabilities within the ASC 820 framework are beyond the scope of this article.

16 See Securities Act Compliance and Disclosure Interpretation Question 233.02.

17 See Section 7(a) and Rule 436 of the Securities Act.

18 See Securities Act Compliance and Disclosure Interpretation Question 233.02.

19 See SEC staff guidance in CF Disclosure Guidance: Topic No. 6.

20 See SEC Release No. 34-73339 (Oct. 10, 2014) at 3.

21 Id. at 11 and 13.